The International Monetary Fund is urging Japan to refrain from cutting its consumption tax to avoid fanning fiscal risks. https://www.japantimes.co.jp/business/2026/02/18/economy/imf-japan-fiscal-risks/?utm_medium=Social&utm_source=mastodon #business #economy #imf #japaneseeconomy #taxes #inflation #bonds #debt

Prime Minister Sanae Takaichi’s landslide election win saw a largely positive initial response from investors. But they remain wary of another market meltdown over her expansive spending plans. https://www.japantimes.co.jp/business/2026/02/12/markets/bond-market-wary-takaichi-spending/?utm_medium=Social&utm_source=mastodon #business #markets #bonds #japaneseeconomy #sanaetakaichi #debt #boj #taxes #consumptiontax

The Japanese government's total debt as of the end of December 2025 rose by ¥8.58 trillion from three months before to a record ¥1.34 quadrillion. https://www.japantimes.co.jp/business/2026/02/10/economy/japan-government-debt-record/?utm_medium=Social&utm_source=mastodon #business #economy #debt #diet

Wikipedia might blacklist Archive.today after site maintainer DDoSed a blog

DDoS hit blog that tried to uncover Archive.today founder's identity in 2023.

https://arstechnica.com/tech-policy/2026/02/wikipedia-might-blacklist-archive-today-after-site-maintainer-ddosed-a-blog/?utm_brand=arstechnica&utm_social-type=owned&utm_source=mastodon&utm_medium=social

@arstechnica A real chance to reduce your debt at no cost to you! 💰

Join the $50k Personal Debt Relief Giveaway today and take control of your finances. Simply enter your ZIP code and complete the steps on the website to qualify. No hidden fees, no risk—just a limited-time opportunity to get real financial relief. Hurry, time is running out. Visit the site now and complete the process before it’s gone!

https://www.chd93jds.com/CD2KW8S/433QLM/

#debt #relief #cedit

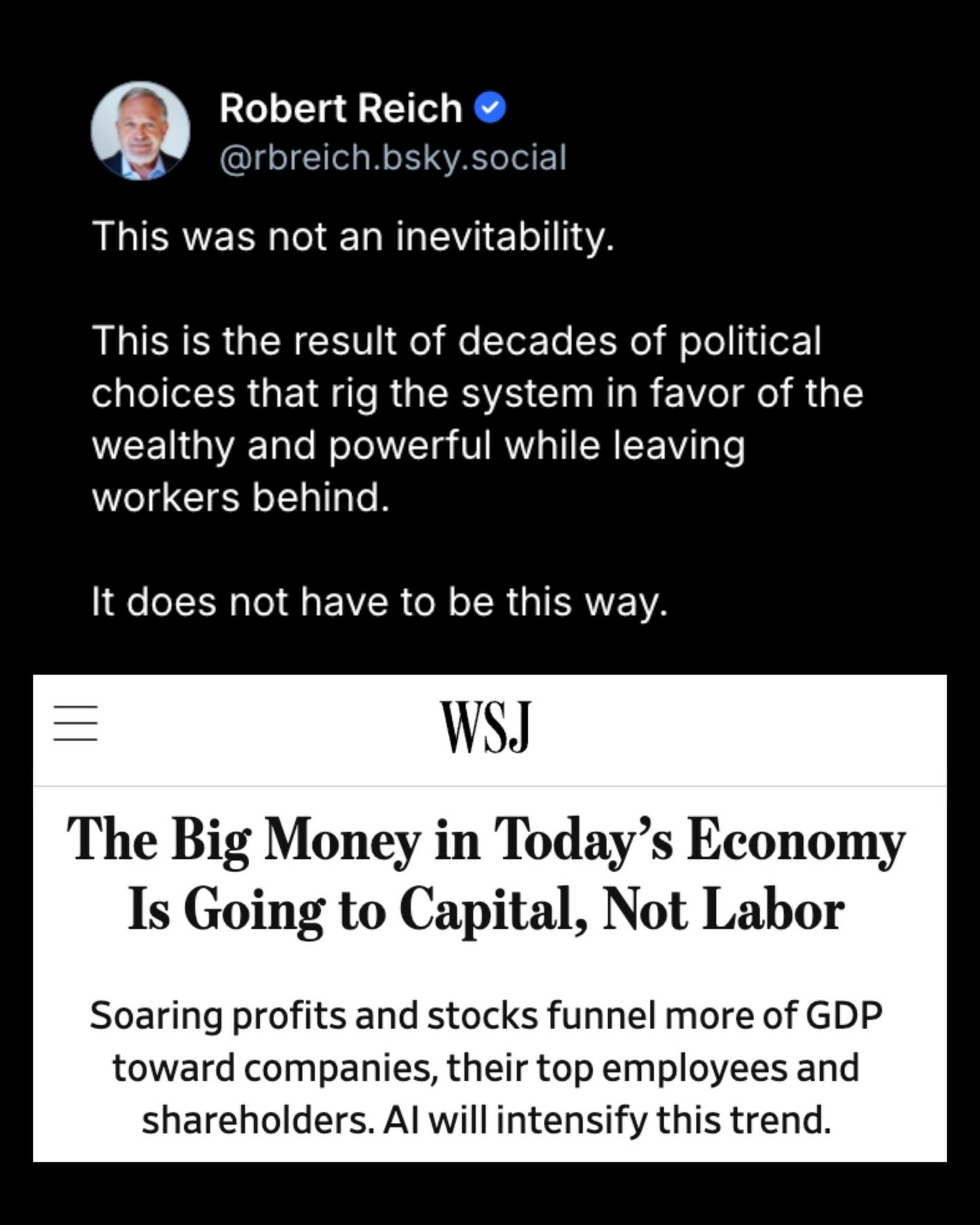

@rbreich A real chance to reduce your debt at no cost to you! 💰

Join the $50k Personal Debt Relief Giveaway today and take control of your finances. Simply enter your ZIP code and complete the steps on the website to qualify. No hidden fees, no risk—just a limited-time opportunity to get real financial relief. Hurry, time is running out. Visit the site now and complete the process before it’s gone!

https://www.chd93jds.com/CD2KW8S/433QLM/

#debt #relief #cedit

Most of the commentary on national economies focusses on debt in the public sector as a risk to (fiscal) stability... but for many countries levels of private (household) debt are of similar magnitudes, yet this seems (to financial commentators) less of a risk?

Since the last global financial crisis was caused by widespread problems in institutional treatment of the risk of household default(s) on housing debt this seems, shall we say, myopic at the least.

The extraordinary run-up in gold prices has brought unexpected windfalls to millions of Vietnamese, but it has also made traditional wedding gifts unaffordable and all but ended the informal gold mortgage system. https://www.japantimes.co.jp/business/2026/01/30/markets/vietnam-soaring-gold-crushing-weight/?utm_medium=Social&utm_source=mastodon #business #markets #vietnam #gold #debt #banks

China's role as a leading financier to developing nations has shifted, with new loans to poorer countries falling sharply while debt repayments continue to rise, according to analysis. https://www.japantimes.co.jp/business/2026/01/27/economy/african-money-china-loans/?utm_medium=Social&utm_source=mastodon #business #economy #china #africa #debt #beltandroad

Takaichi might surprise markets that are bracing for an unrestrained fiscal dove after the election in Japan. https://www.japantimes.co.jp/business/2026/01/19/economy/takaichi-fiscal-policy-election/?utm_medium=Social&utm_source=mastodon #business #economy #sanaetakaichi #diet #ldp #tse #nikkei #stocks #budgets #debt #economicindicators

Stablecoins are likely to be a factor, not a game changer, in Japan’s bond market as issues will focus on buying short-term debt. https://www.japantimes.co.jp/business/2026/01/05/markets/stablecoins-bond-market/?utm_medium=Social&utm_source=mastodon #business #markets #jpyc #stablecoins #currencies #digitalization #cashless #sbi #shinseibank #banks #bonds #debt #financeministry #japaneseeconomy #jgb

While the government's fiscal 2026 budget bill calls for record-high spending on social security, its efforts to reduce the health insurance premium burden on the working generation are still limited. https://www.japantimes.co.jp/news/2025/12/27/japan/society/burden-working-generation/?utm_medium=Social&utm_source=mastodon #japan #society #health #sanaetakaichi #ldp #nipponishinnokai #budgets #debt #elderly #medicine

Prime Minister Sanae Takaichi said the nation’s primary balance is set to return to a surplus for the first time in 28 years, in an apparent attempt to ease market concerns over her proactive stance on spending. https://www.japantimes.co.jp/business/2025/12/27/economy/primary-balance-surplus/?utm_medium=Social&utm_source=mastodon #business #economy #sanaetakaichi #ldp #budgets #debt #japaneseeconomy

Housing loans with repayment periods of up to 50 years, far longer than the standard 35-year term for long-term mortgages, are gaining popularity in Japan, particularly among people in their 20s. https://www.japantimes.co.jp/business/2025/12/25/economy/japan-superlong-housing-loans/?utm_medium=Social&utm_source=mastodon #business #economy #housing #realestate #debt #japaneseeconomy

The Finance Ministry will set a key rate used to calculate the country’s likely interest payments on bonds next fiscal year at 3.0%, the highest in nearly three decades. https://www.japantimes.co.jp/business/2025/12/24/economy/interest-payments-on-bonds/?utm_medium=Social&utm_source=mastodon #business #economy #budgets #bonds #debt #financeministry #japaneseeconomy

As candidates vie to become chair of the U.S. Federal Reserve, it's unclear whether the central bank will maintain enough autonomy and credibility to manage the economy under pressure from politics and the market. https://www.japantimes.co.jp/commentary/2025/12/23/world/fed-autonomy-credibility/?utm_medium=Social&utm_source=mastodon #commentary #worldnews #us #federalreserve #supremecourt #donaldtrump #dollar #currencies #globaleconomy #debt #ai

A prospective rise in Japanese interest rates could indicate that not only Japan, but also other heavily indebted economies, including the United States, could face sharply higher yields on government bonds. https://www.japantimes.co.jp/commentary/2025/12/16/japan/japan-global-debt-warning/?utm_medium=Social&utm_source=mastodon #commentary #japan #boj #debt #monetarypolice #japaneseeconomy #globaleconomy #inflation

Mounting #debtcrisis means #globalSouth governments are spending on average 15% of their revenue servicing external #debt. This figure has doubled since 2010.

More than 3.4 billion people now live in countries that spend more on interest payments than on #health or #education.

https://globalinequality.org/debt-financial-outflows/

#Politics #Democrats #Republicans #Liberals #Conservatives #DemocraticParty #RepublicanParty #DonaldTrump #Trump #JoeBiden #Biden #KamalaHarris #TimWalz #Democracy #USA #Musk #Fascism #Fascist

Mounting #debtcrisis means #globalSouth governments are spending on average 15% of their revenue servicing external #debt. This figure has doubled since 2010.

More than 3.4 billion people now live in countries that spend more on interest payments than on #health or #education.

https://globalinequality.org/debt-financial-outflows/

#Politics #Democrats #Republicans #Liberals #Conservatives #DemocraticParty #RepublicanParty #DonaldTrump #Trump #JoeBiden #Biden #KamalaHarris #TimWalz #Democracy #USA #Musk #Fascism #Fascist

These Health Centers Are Supposed to Make Care Affordable. One Has Sued Patients for as Little as $59 in Unpaid Bills.

---

Federally funded community health centers receive grants in exchange for serving patients regardless of their ability to pay. But ProPublica found at least five across the country filing lawsuits and garnishing paychecks to collect unpaid bills.

https://www.propublica.org/article/federally-qualified-health-centers-unpaid-bills-lawsuits?utm_source=mastodon&utm_medium=social&utm_campaign=mastodon-post

RE: https://toot.cat/@EveHasWords/115606885361754835

THIS IS IMPORTANT!

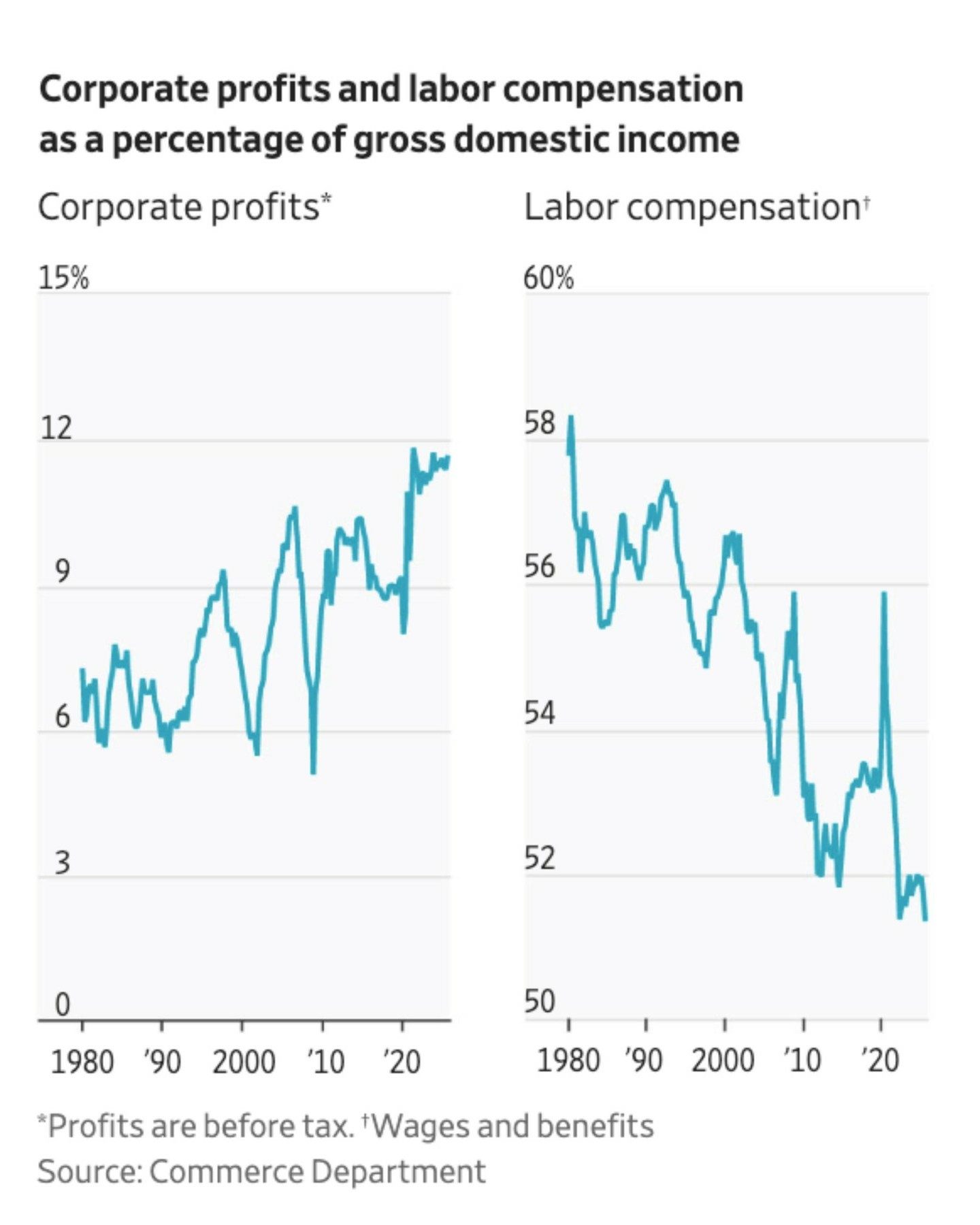

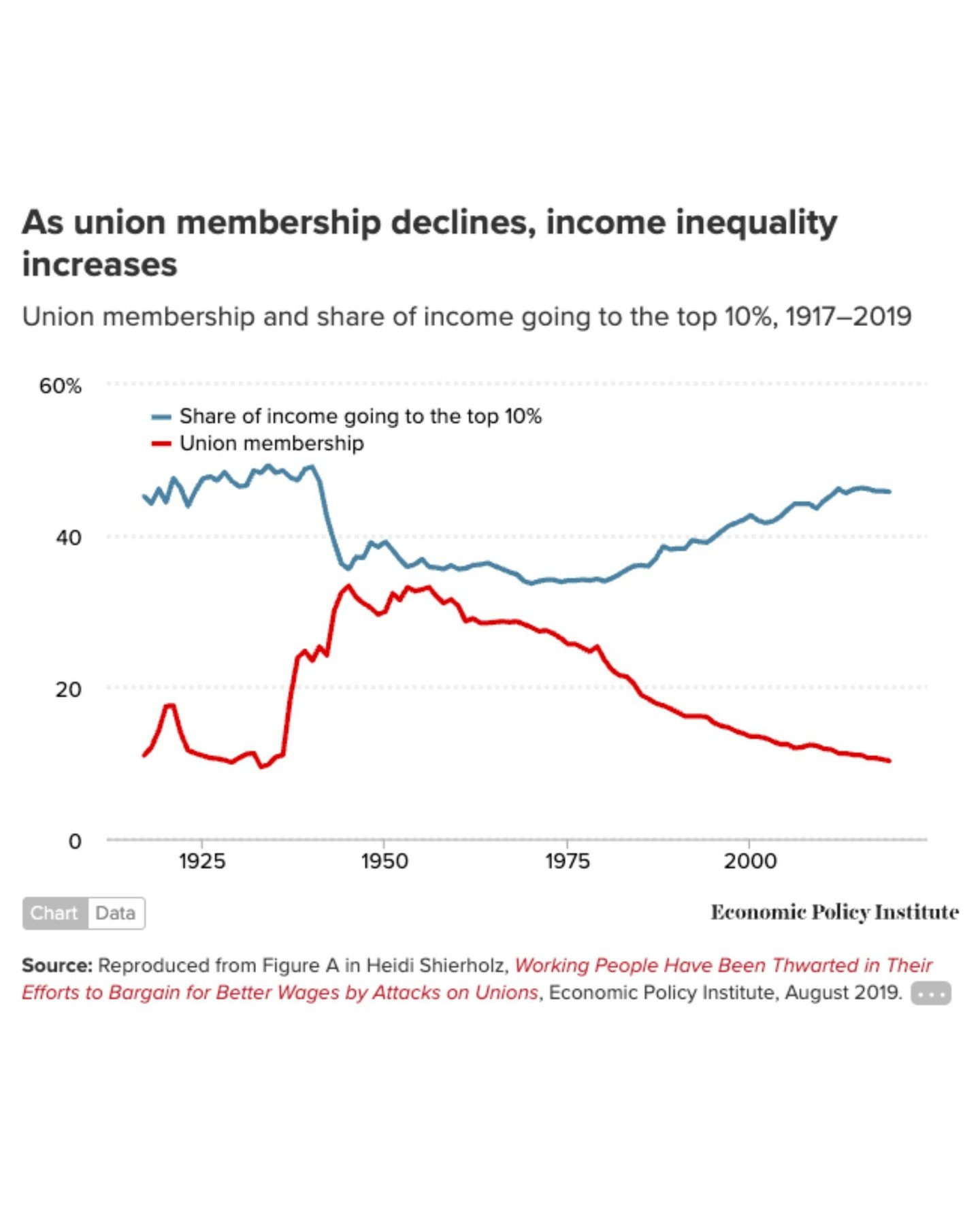

because if wages have been stagnant for 44 years, that means people have been going into #debt, using credit cards to buy what they can’t afford.

make it a priority to not use your credit card for the next month. can’t pay cash? don’t go into debt. stick with that phone or computer or car for as long as you can.

the less you use your credit cards, the less #billionaires we will end up having.

starve the #oligarchy of our debt.

Tech companies are crying that Americans aren't buying new phones fast enough to keep the economy stimulated. Wages have been stagnant for, what, 44 years and you've got the gall to keep raising prices and cry we're not buying enough?

I don't think you should reward this shit with a click but, in case you must, I've got a barely tweaked URL to save you the trouble I already spent looking up the article.

source: cnbc DOT com/2025/11/23/how-device-hoarding-by-americans-is-costing-economy.html