Bitcoin and other cryptocurrencies’ latest plunge further underscores the highly volatile nature of this pseudo-asset class; one only hopes that policymakers will wake up to the risks before it’s too late. https://www.japantimes.co.jp/commentary/2026/02/10/world/coming-crypto-apocalypse/?utm_medium=Social&utm_source=mastodon #commentary #worldnews #cryptocurrencies #donaldtrump #bitcoin #stablecoins #banking #blockchains #monetarypolicy

Ω🪬Ω

#TheCryptocalypseChronicles: A Rather Alarming Epstein / Russia / Israel Crypto Timeline

The recently released #EpsteinFiles make it crystal clear that #Epstein's involvement in #crypto was much deeper and long lasting than had been previously understood.

Not only do we now know that Epstein funded bitcoin's development team at #MIT starting from 2015, we also now know that #Epstein introduced #Tether co-founder, #SteveBannon business partner, #EOS scammer, and man with an extremely sordid history of sex crimes against children #BrockPierce to former #Harvard president #LarrySummers. Summers would go on to join the board of #DigitalCurrencyGroup ( #DCG), the most important crypto VC fund in the U.S.

Beyond that there's

1. Epstein's proposal to a #Russian #FSB operative that they should create a #BRICS stablecoin

2. A bunch of sinister sounding emails between Epstein and"influential men" in #Qatar about "the e-currency"

3. Bannon + Epstein's plot to undermine Europe with crypto money

4. The integration of #BrockPierce and the #Netanyahu family

5. Accusations from the former head of #Mossad's financial unit about Netanyahu's involvement in crypto

6. The relationship between Chinese criminal #MilesGuo AKA #MilesKwok, Steve Bannon, and Epstein

...and so much more. Retoots appreciated.

* Substack: https://cryptadamus.substack.com/p/the-epsteincrypto-timeline-is-alarming

* DocumentCloud (for Substack haters): https://www.documentcloud.org/documents/26363321-a-rather-alarming-epstein-russia-israel-crypto-timeline/

#JeffreyEpstein #uspol #uspolitics #eupol #ukpol #MAGA #Tether #stablecoin #stablecoins #USDT #JustinSun

🗣️ NEW: Goldman Sachs CEO David Solomon said the firm is devoting significant resources to #tokenization, #stablecoins, and prediction markets.

The argument that dollar-pegged stablecoins will extend it rests on a slew of shaky assumptions and leaves key questions unanswered. https://www.japantimes.co.jp/commentary/2026/01/05/world/will-stablecoins-preserve-dollar-dominance/?utm_medium=Social&utm_source=mastodon #commentary #worldnews #stablecoins #cryptocurrencies #usdollar #donaldtrump #us #monetarypolicy #trade #globaleconomy

Stablecoins are likely to be a factor, not a game changer, in Japan’s bond market as issues will focus on buying short-term debt. https://www.japantimes.co.jp/business/2026/01/05/markets/stablecoins-bond-market/?utm_medium=Social&utm_source=mastodon #business #markets #jpyc #stablecoins #currencies #digitalization #cashless #sbi #shinseibank #banks #bonds #debt #financeministry #japaneseeconomy #jgb

Japan's first bank-backed yen-based stablecoin could be available by 2026 with the payments market as one of the main targets for the product https://www.japantimes.co.jp/business/2025/12/16/tech/sbi-stablecoin/?utm_medium=Social&utm_source=mastodon #business #tech #jpyc #stablecoins #currencies #digitalization #cashless #sbi #shinseibank #banks

Ω🪬Ω

#TheCryptocalypseChronicles: A Rather Alarming Epstein / Russia / Israel Crypto Timeline

The recently released #EpsteinFiles make it crystal clear that #Epstein's involvement in #crypto was much deeper and long lasting than had been previously understood.

Not only do we now know that Epstein funded bitcoin's development team at #MIT starting from 2015, we also now know that #Epstein introduced #Tether co-founder, #SteveBannon business partner, #EOS scammer, and man with an extremely sordid history of sex crimes against children #BrockPierce to former #Harvard president #LarrySummers. Summers would go on to join the board of #DigitalCurrencyGroup ( #DCG), the most important crypto VC fund in the U.S.

Beyond that there's

1. Epstein's proposal to a #Russian #FSB operative that they should create a #BRICS stablecoin

2. A bunch of sinister sounding emails between Epstein and"influential men" in #Qatar about "the e-currency"

3. Bannon + Epstein's plot to undermine Europe with crypto money

4. The integration of #BrockPierce and the #Netanyahu family

5. Accusations from the former head of #Mossad's financial unit about Netanyahu's involvement in crypto

6. The relationship between Chinese criminal #MilesGuo AKA #MilesKwok, Steve Bannon, and Epstein

...and so much more. Retoots appreciated.

* Substack: https://cryptadamus.substack.com/p/the-epsteincrypto-timeline-is-alarming

* DocumentCloud (for Substack haters): https://www.documentcloud.org/documents/26363321-a-rather-alarming-epstein-russia-israel-crypto-timeline/

#JeffreyEpstein #uspol #uspolitics #eupol #ukpol #MAGA #Tether #stablecoin #stablecoins #USDT #JustinSun

Stablecoins are designed not to fluctuate in value, and that could attract users interested in making quick and cheap transfers and payments. https://www.japantimes.co.jp/business/2025/11/14/tech/stablecoins-explainer/?utm_medium=Social&utm_source=mastodon #business #tech #jpyc #stablecoins #currencies #digitalization #cashless

The world’s first yen stablecoin, JPYC, could make one-second transfers costing less than ¥1 a reality. https://www.japantimes.co.jp/business/2025/10/27/tech/jpyc-first-yen-pegged-stablecoin/?utm_medium=Social&utm_source=mastodon #business #tech #jpyc #stablecoins #currencies

Ω🪬Ω

➤ Making Argentina Great Again

it is incredibly suspicious to me that the US Treasury fund #Bessent wants to use to bail out #Argentina and Javier #Milei is almost exactly the same size as the amount of money #Tether is suddenly trying to raise via a “private placement”.

Tether is one of the most profitable companies in the history of the world, at least according to their own unaudited / unverified numbers. There should be no reason for them to need to raise capital and no desire on their part to sell off part of their cash cow.

Puting aside for a moment the absurdity of the idea that the central bank of international criminal finance considers itself to be in the same league as companies like Google, Nvidia, and Tesla, I can think of 3 possible explanations:

1. Tether is (somehow) out of cash. This is lent some credence by the fact that they are failing to pay their electricity bill in #Uruguay and had their power turned off a few weeks ago.

2. Tether wants to get some shares into the hands of corrupt government officials (other than Howard “Nutlick” #Lutnick, who already has some) for protection.

3. Now that the #Fed has pivoted and cut rates Tether’s income is about to start dropping (and the more the fed cuts, the more it will drop) so they are just cashing out the founders at the top. This is the most charitable interpretation.

it’s also worth mentioning that:

1. Tether’s #USDT token is very popular with #Argentinians trying to avoid that country’s hyperinflation. While technically illegal because of capital controls, it’s still a “crime” I have some sympathy for. But it does mean there’s an important connection between Tether and Argentina.

2. Tether is a major shareholder in south american agriculture business #Adecoagro which does a lot of work in Argentina.

more on Tether: https://cryptadamus.substack.com/p/trumps-transition-team-is-tethered

#uspol #MAGA #uspolitics #ScottBessent #treasury #finance #economics #bailout #IMF #WEF #WorldBank #howardLutnick #stablecoins

Ω🪬Ω

➤ Making Argentina Great Again

it is incredibly suspicious to me that the US Treasury fund #Bessent wants to use to bail out #Argentina and Javier #Milei is almost exactly the same size as the amount of money #Tether is suddenly trying to raise via a “private placement”.

Tether is one of the most profitable companies in the history of the world, at least according to their own unaudited / unverified numbers. There should be no reason for them to need to raise capital and no desire on their part to sell off part of their cash cow.

Puting aside for a moment the absurdity of the idea that the central bank of international criminal finance considers itself to be in the same league as companies like Google, Nvidia, and Tesla, I can think of 3 possible explanations:

1. Tether is (somehow) out of cash. This is lent some credence by the fact that they are failing to pay their electricity bill in #Uruguay and had their power turned off a few weeks ago.

2. Tether wants to get some shares into the hands of corrupt government officials (other than Howard “Nutlick” #Lutnick, who already has some) for protection.

3. Now that the #Fed has pivoted and cut rates Tether’s income is about to start dropping (and the more the fed cuts, the more it will drop) so they are just cashing out the founders at the top. This is the most charitable interpretation.

it’s also worth mentioning that:

1. Tether’s #USDT token is very popular with #Argentinians trying to avoid that country’s hyperinflation. While technically illegal because of capital controls, it’s still a “crime” I have some sympathy for. But it does mean there’s an important connection between Tether and Argentina.

2. Tether is a major shareholder in south american agriculture business #Adecoagro which does a lot of work in Argentina.

more on Tether: https://cryptadamus.substack.com/p/trumps-transition-team-is-tethered

#uspol #MAGA #uspolitics #ScottBessent #treasury #finance #economics #bailout #IMF #WEF #WorldBank #howardLutnick #stablecoins

NYT article about Changpeng Zhao’s quest for a presidential pardon. Worth remembering that Trump’s World Liberty Financial has already launched its #stablecoin#USD1 mostly on the Binance blockchain (BNB) and USD1’s usage in decentralized finance is 99% happening on Binance fake decentralized exchanges (PancakeSwap).

* NYT: https://www.nytimes.com/2025/08/09/us/politics/changpeng-zhao-pardon-trump.html

* Chart of USD1 DEX usage: https://x.com/Cryptadamist/status/1953550895268212945

#CZ#Binance#BNB#BNBChain#WLFI #worldlibertyfinancial #trump #uspol #uspolitics #pardon#corruption #pardons #stablecoins #crypto #cryptocurrency

NYT article about Changpeng Zhao’s quest for a presidential pardon. Worth remembering that Trump’s World Liberty Financial has already launched its #stablecoin#USD1 mostly on the Binance blockchain (BNB) and USD1’s usage in decentralized finance is 99% happening on Binance fake decentralized exchanges (PancakeSwap).

* NYT: https://www.nytimes.com/2025/08/09/us/politics/changpeng-zhao-pardon-trump.html

* Chart of USD1 DEX usage: https://x.com/Cryptadamist/status/1953550895268212945

#CZ#Binance#BNB#BNBChain#WLFI #worldlibertyfinancial #trump #uspol #uspolitics #pardon#corruption #pardons #stablecoins #crypto #cryptocurrency

"Why The Stablecoin Hype Won't Reach Americans' Wallets Anytime Soon

Stablecoins offer promising improvements for cross-border transactions. But for domestic payments in developed economies, they’re a solution looking for a problem."

Jeff Kauflin for @Forbes

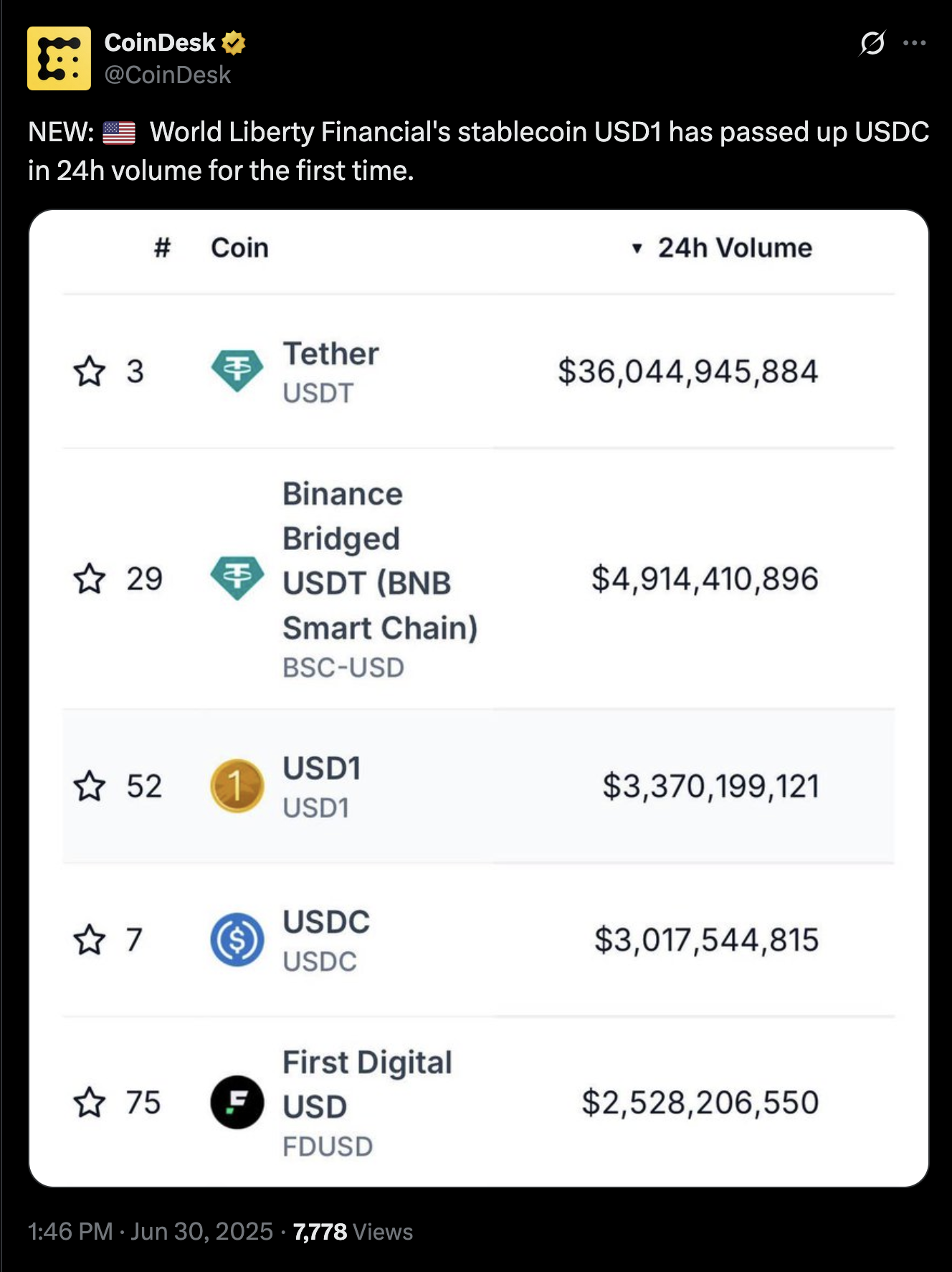

the trump and witkoff families' #stablecoin#USD1 has existed for like 4 weeks and it's already seeing more reported trading volume than the coinbase aligned Circle's stablecoin #USDC, which i'm sure is because of entirely legitimate financial activity and not because chinese crypto exchanges like #Binance and #OKX are wash trading and/or reporting fake volumes

#corruption #trump #stablecoins#geniusAct #uspol #uspolitics #crypto #cryptocurrency#WLFI #worldlibertyfinancial #stevewitkoff#CRCL#Circle

the trump and witkoff families' #stablecoin#USD1 has existed for like 4 weeks and it's already seeing more reported trading volume than the coinbase aligned Circle's stablecoin #USDC, which i'm sure is because of entirely legitimate financial activity and not because chinese crypto exchanges like #Binance and #OKX are wash trading and/or reporting fake volumes

#corruption #trump #stablecoins#geniusAct #uspol #uspolitics #crypto #cryptocurrency#WLFI #worldlibertyfinancial #stevewitkoff#CRCL#Circle

whenever the price of #bitcoin starts to drop because of global instability (or any other reason) “investors” immediately decide to send billions of dollars to #Tether, a financial company that more or less openly works with #Iran, has almost no employees, has been linked to hundreds of financial crimes, and has never produced an audit to prove it actually has all the money it says it does to back its #stablecoin#USDT. it's like clockwork.

today’s crash saw an immediate creation of $2 billion USDT, 100% of it on Donald Trump’s new business partner Justin Sun’s blockchain Tron (AKA “the crime chain”).

whenever the price of #bitcoin starts to drop because of global instability (or any other reason) “investors” immediately decide to send billions of dollars to #Tether, a financial company that more or less openly works with #Iran, has almost no employees, has been linked to hundreds of financial crimes, and has never produced an audit to prove it actually has all the money it says it does to back its #stablecoin#USDT. it's like clockwork.

today’s crash saw an immediate creation of $2 billion USDT, 100% of it on Donald Trump’s new business partner Justin Sun’s blockchain Tron (AKA “the crime chain”).