Newsletter: Bitcoin is down 50%, several prominent industry figures have been uncovered in the Epstein files, Trump’s facing a probe into his family’s $500M deal with the UAE, and crypto super PACs spend their first $6 million in the midterms.

Newsletter: Bitcoin is down 50%, several prominent industry figures have been uncovered in the Epstein files, Trump’s facing a probe into his family’s $500M deal with the UAE, and crypto super PACs spend their first $6 million in the midterms.

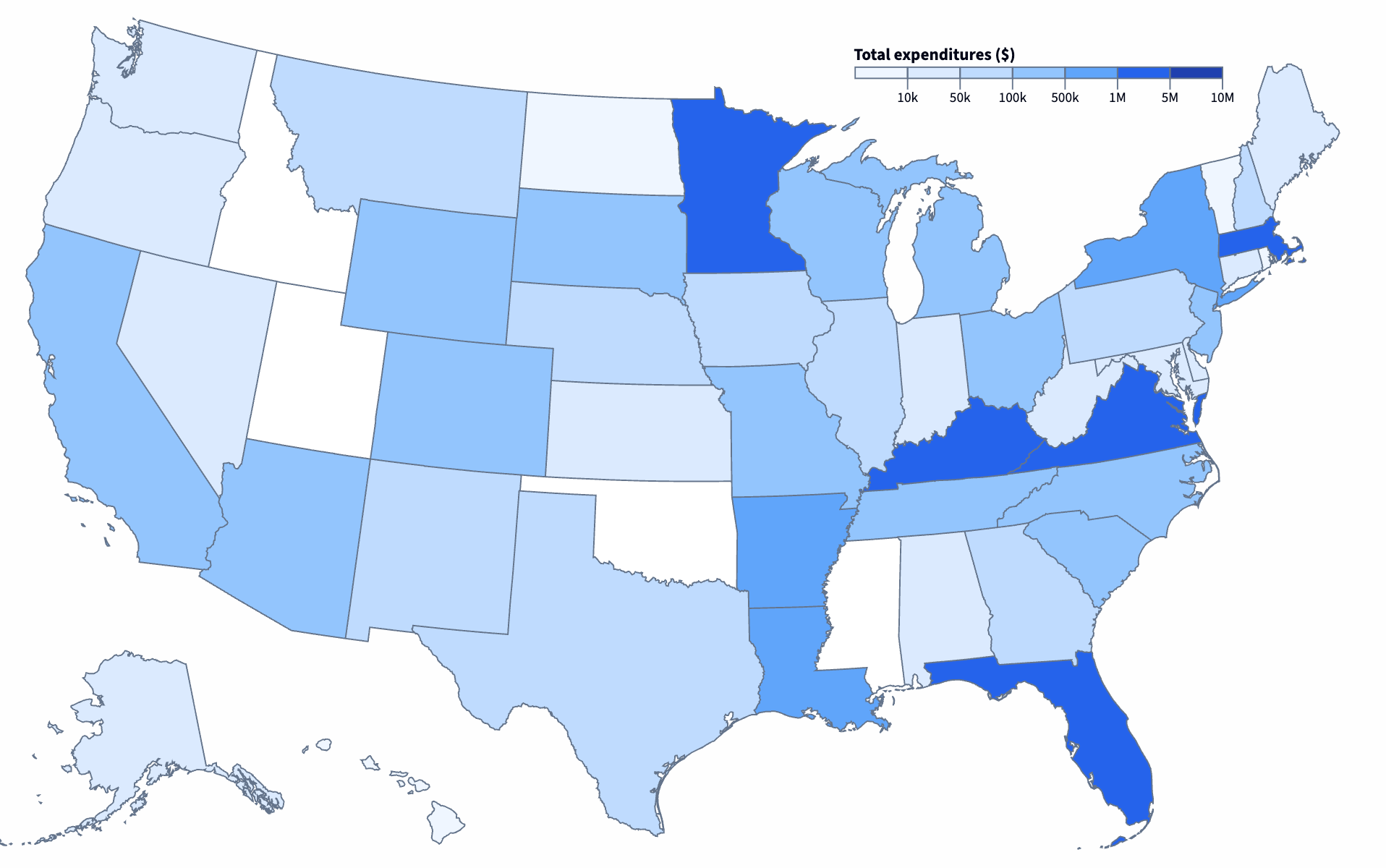

Newsletter: With Trump faltering and their policy agenda incomplete, the cryptocurrency industry has moved at least $288 million toward the midterms in a desperate bid to keep Republicans in control of Congress.

https://www.citationneeded.news/crypto-super-pacs-2026-midterms/

#crypto #cryptocurrency #USpolitics #USpol #CitationNeededNewsletter

Newsletter: With Trump faltering and their policy agenda incomplete, the cryptocurrency industry has moved at least $288 million toward the midterms in a desperate bid to keep Republicans in control of Congress.

https://www.citationneeded.news/crypto-super-pacs-2026-midterms/

#crypto #cryptocurrency #USpolitics #USpol #CitationNeededNewsletter

#politics #cryptocurrency #IRS #MoneyLaundering

'Even before the recent reductions, the IRS struggled to oversee dirty money in the fast-growing crypto sector, according to experts. '

#politics #cryptocurrency #IRS #MoneyLaundering

'Even before the recent reductions, the IRS struggled to oversee dirty money in the fast-growing crypto sector, according to experts. '

Jeffrey Epstein associated with major Bluesky investor Blockchain Capital

Latest Epstein document releases reveal that he was involved in Blockchain Capital and closely associated with its founder Brock Pierce. Blockchain Capital also led the latest Bluesky funding round.

Source: Dave Troy on X, https://xcancel.com/davetroy/status/2023254347870884003

This article has more and mentions Brock Pierce was in touch with Epstein until 2019: https://medium.com/coinmonks/bitcoins-epstein-connection-the-cat-is-finally-out-of-the-bag-3e8afe071244

Shocking to discover in the #EpsteinFiles that #Bitcoin was used extensively for #HumanTrafficking, rather than the usual drug shipments, money laundering, and investment scams that are somehow a legitimate use of #cryptocurrency.

Shocking to discover in the #EpsteinFiles that #Bitcoin was used extensively for #HumanTrafficking, rather than the usual drug shipments, money laundering, and investment scams that are somehow a legitimate use of #cryptocurrency.

Binance bitcoin bailout