fell into a strange rabbit hole reading about the "XMTP" protocol, a new "decentralized" "encrypted messaging" protocol with "55 million users"

@liaizon I am afraid that its focus on #web3 and #ethereum will make adoption hard. Specifically that the way to get something like a username is to register on ENS (requiring you to buy crypto). By default you get a wallet address which is nowhere near human readable. Message history seems to be another challenge. Also, Its connection to #coinbase doesn’t help build trust.

Thanks for shinning a light. I will keep an eye on it. For now, I am going with #matrix instead of #xmtp

![Coinbase

On May 12, Coinbase announced it will join the S&P 500 as its “first and only crypto company”.1a This is the latest change that may see more American investors inadvertently exposed to the cryptocurrency industry via index funds, following MicroStrategy’s entry into the NASDAQ-100 in December 2024 [I72].

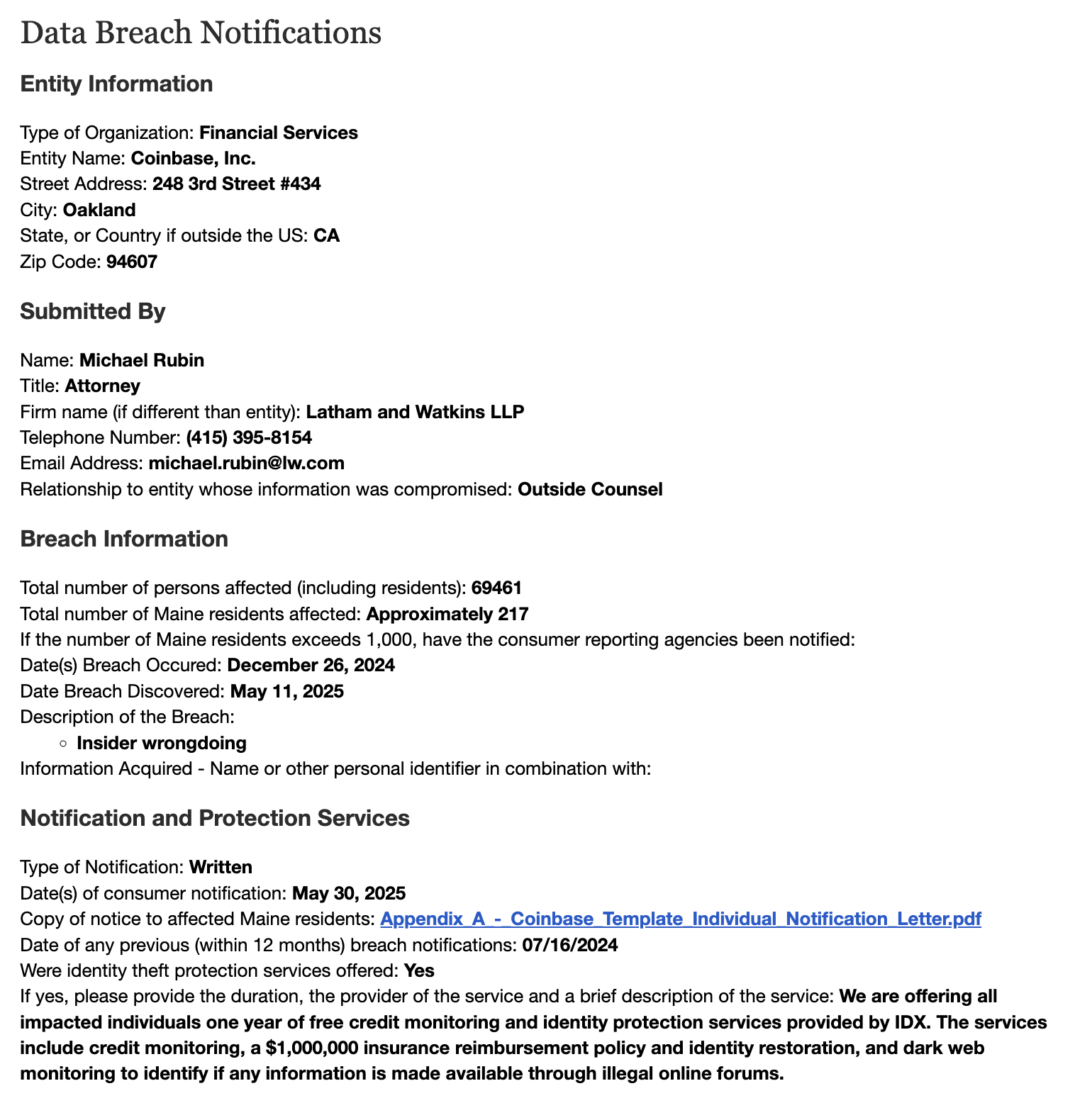

Their joy was likely tempered when, only two days later on May 14, they had to announce a data breach that exposed customer data including names, addresses, phone numbers, email addresses, images of government ID documents, account balance and transaction data, and masked social security and bank account numbers. Although leaks like this typically lead to an uptick in phishing attempts, where scammers use the private information to contact customers and more convincingly impersonate Coinbase employees, the leak of account balance data and customer addresses is also particularly concerning given the recent spike in violent attacks and kidnappings targeting wealthy crypto holders.

Crypto security researchers have been warning for months about Coinbase’s evidently poor security practices and lack of attention to customer complaints, and describing hacks in which victims reported being scammed by attackers who seemed to have access to private Coinbase data [I76]. In February, zachxbt wrote: “Coinbase needs to urgently make changes as more and more users are being scammed for tens of millions every month. ... Coinbase is in a position where they have the power to make](https://media.hachyderm.io/media_attachments/files/114/542/355/565/850/346/original/ed7d433d8bf281ce.png)