@ChrisMayLA6 I'm curious about the business models that lead to some of this.

A few years ago, we got some awnings installed on our house. The company offered interest-free credit. There was no down side to taking this (pay 1/3 up front, and then 1/3 each year in monthly instalments over the next 24 months and you pay the same amount in total as paying all of it up front). Keeping the money meant I might earn interest on it, and at least meant I had some more emergency flexibility, so I took that option.

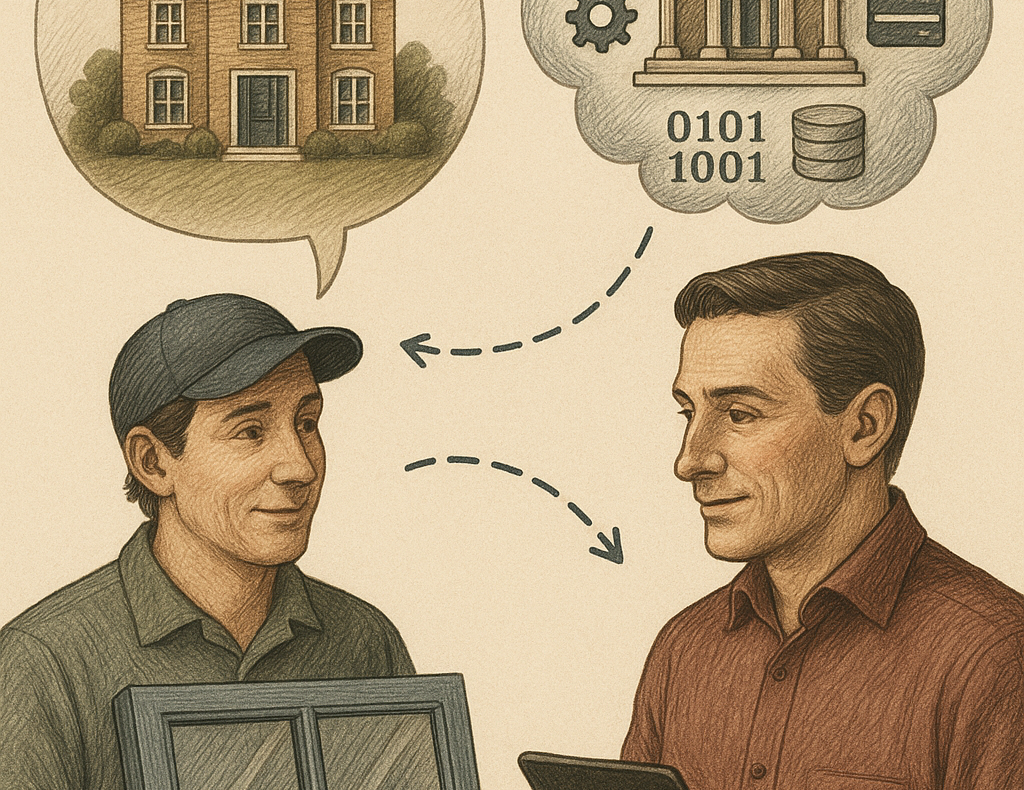

But the thing that surprised me when I agreed was that this was actually done via a third-party company that offered the loan. I don't see how this works. If they charge companies, not taking the interest-free loan option should be cheaper (it wasn't). Do they make money when people default and have to repay with interest more slowly? Do enough people default who are still able to pay back the capital with interest relative to the ones that go bankrupt or pay back without interest to make this worthwhile? It seemed very odd.

I was a little nervous about the impact this additional debt would have on my credit rating when I quit my job and was unpaid for a bit setting up a startup, but it didn't seem to make any difference (at least with Experian).