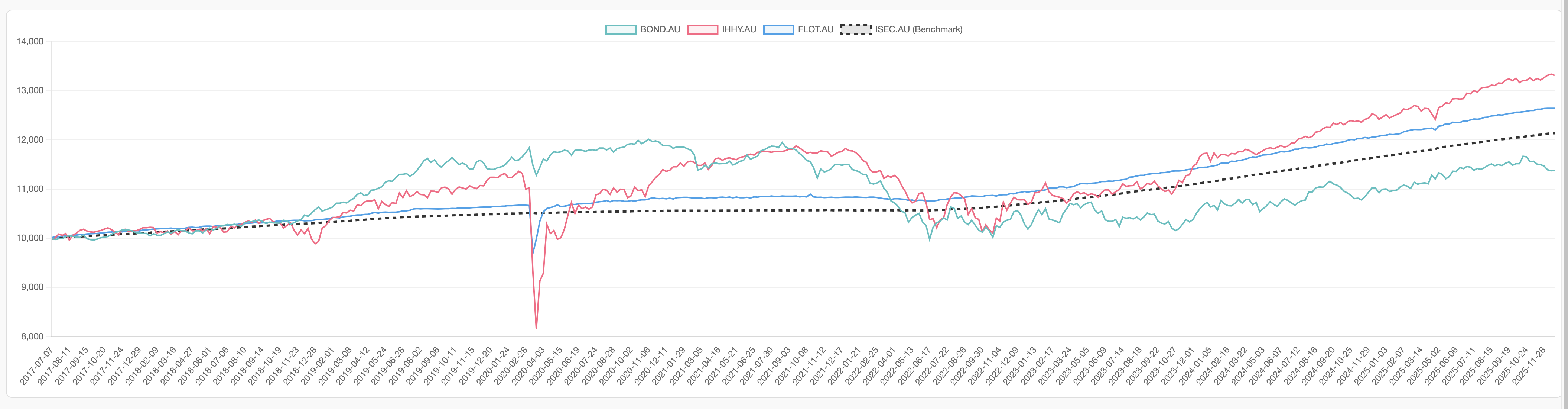

@philbetts exactly the reason why I've been looking into them - I need a "defensive" portion of my investments (and I dislike the volatility of equities because I'm a big scared baby that feels like he has too much to lose when the AI bubble pops) and bonds, well bond ETFs at least, performed really crap even when interest rates went up - but they weren't spectacular when they went down either

That said, I've been looking at ETFs, not holding the actual bonds themselves. If there's a A-grade bond that gives me like 5.5% or 6% for 12m or 24m, that could be a better idea than a term deposit.