CFTC Chair nominee Brian Quintenz has published messages with the Winklevoss twins, accusing them of blackballing him with President Trump after he failed to immediately and enthusiastically champion their grievances.

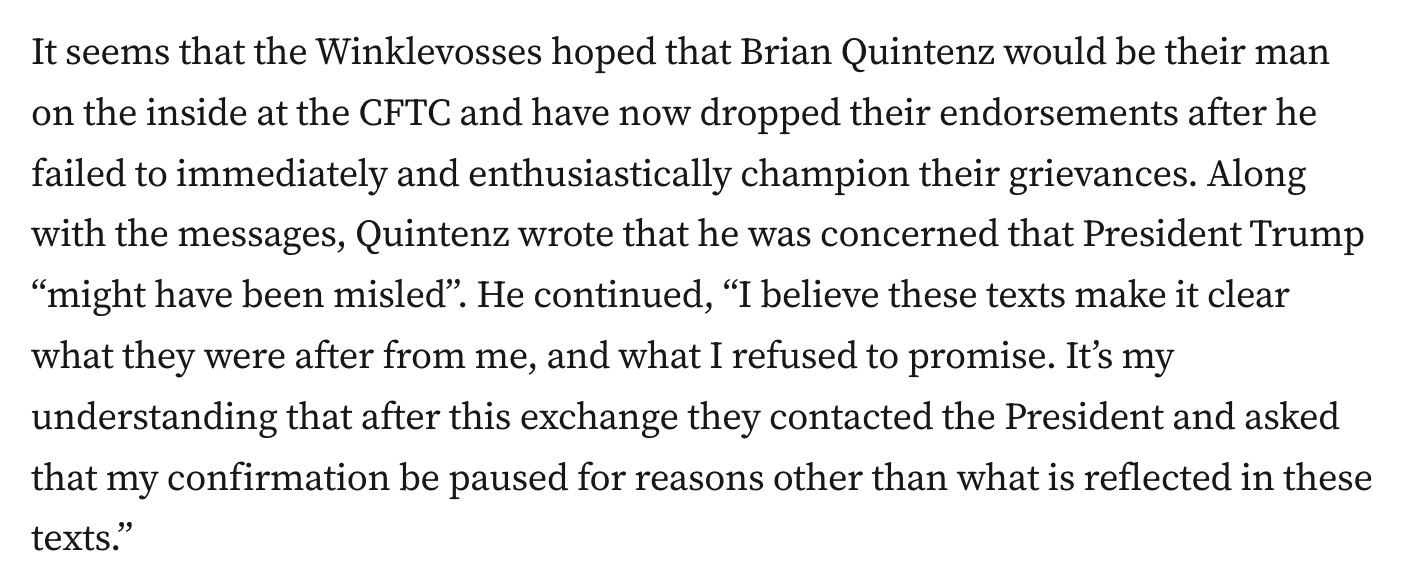

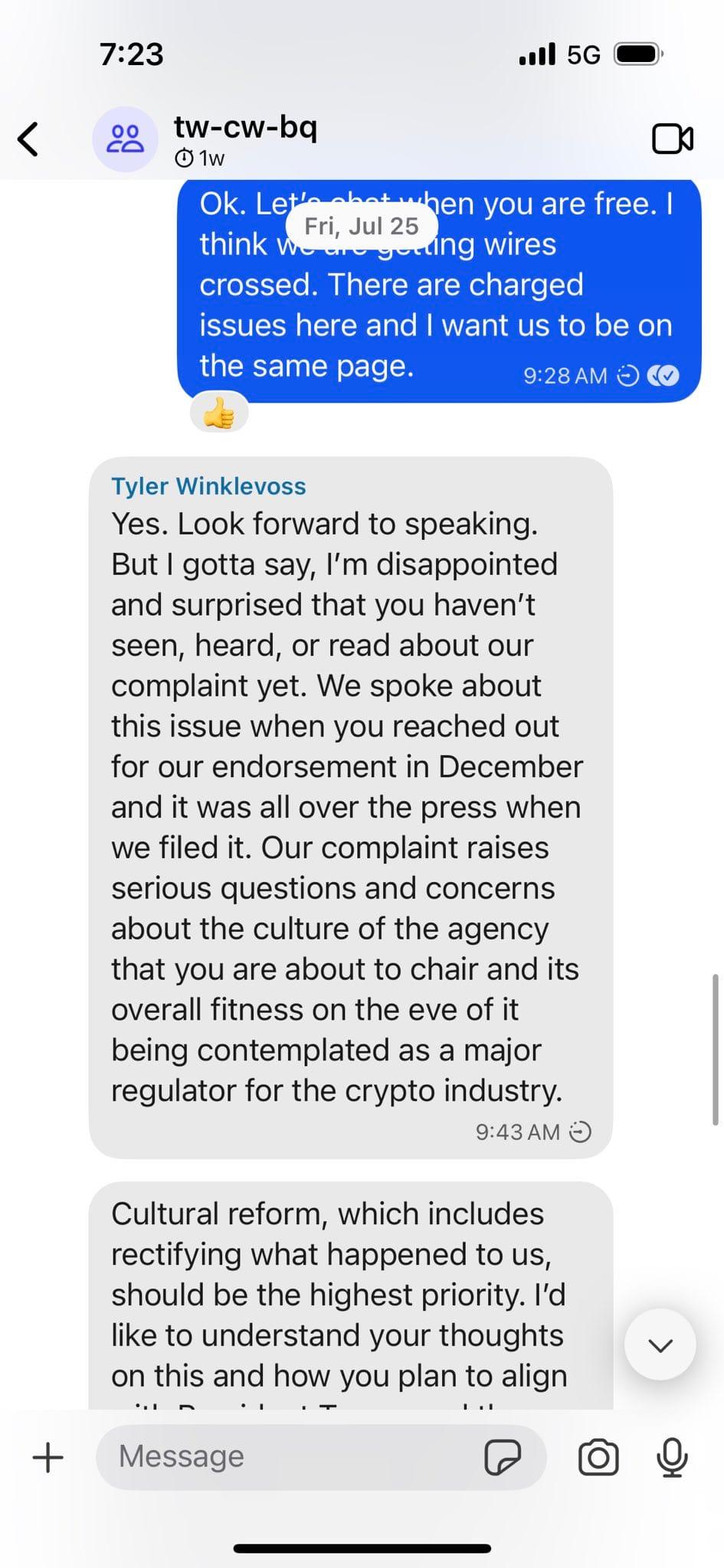

![A new chair for the CFTC has still not been confirmed with the Senate in recess, and the conflict over nominee Brian Quintenz is continuing. Setting aside the issues of questionable emails he sent to the current CFTC Commissioners over their regulation of prediction markets — while he has a conflict of interest as a shareholder and board member at Kalshi — I’ve also outlined in past issues how the once supportive Winklevosses turned against him for seemingly strategy-related differences [I90]. Their opposition has diverged from much of the rest of the crypto industry, which recently sent a supportive letter urging his confirmation [I91]. The reason for this divergence may have just become clear, as Quintenz himself published July messages from a group chat with the Winklevoss twins, who pointed him to a furious public letter they sent to the CFTC Inspector General in June after reaching a settlement with the agency [I86].20 “Please take a look and let me know your thoughts after you’ve read our 13-page letter,” wrote Tyler. “7 years of lawfare trophy hunting. It’s outrageous what they did to us.” Quintenz doesn’t really push back in the conversation, though he seems to try to delay the conversation until his confirmation, writing that their complaints “should be unequivocally left to a fully confirmed chair” but that he “will address this fully and fairly if and when I am confirmed.” Later, Tyler states he is “disappointed and surprised that you haven’t seen, heard, or](https://media.hachyderm.io/media_attachments/files/115/192/182/159/031/628/original/626f9e9191ba1c17.png)

Post

CFTC Chair nominee Brian Quintenz has published messages with the Winklevoss twins, accusing them of blackballing him with President Trump after he failed to immediately and enthusiastically champion their grievances.

![A new chair for the CFTC has still not been confirmed with the Senate in recess, and the conflict over nominee Brian Quintenz is continuing. Setting aside the issues of questionable emails he sent to the current CFTC Commissioners over their regulation of prediction markets — while he has a conflict of interest as a shareholder and board member at Kalshi — I’ve also outlined in past issues how the once supportive Winklevosses turned against him for seemingly strategy-related differences [I90]. Their opposition has diverged from much of the rest of the crypto industry, which recently sent a supportive letter urging his confirmation [I91]. The reason for this divergence may have just become clear, as Quintenz himself published July messages from a group chat with the Winklevoss twins, who pointed him to a furious public letter they sent to the CFTC Inspector General in June after reaching a settlement with the agency [I86].20 “Please take a look and let me know your thoughts after you’ve read our 13-page letter,” wrote Tyler. “7 years of lawfare trophy hunting. It’s outrageous what they did to us.” Quintenz doesn’t really push back in the conversation, though he seems to try to delay the conversation until his confirmation, writing that their complaints “should be unequivocally left to a fully confirmed chair” but that he “will address this fully and fairly if and when I am confirmed.” Later, Tyler states he is “disappointed and surprised that you haven’t seen, heard, or](https://media.hachyderm.io/media_attachments/files/115/192/182/159/031/628/original/626f9e9191ba1c17.png)

The Trump family scored huge windfalls this week as WLFI became available for trading, and American Bitcoin went public. Their WLFI stake has been reported at multi-billions of dollars, though this valuation suffers from the usual crypto pricing issues I’ve written about before.

![One could reasonably complain that I’m counting the trees while the forest burns on this point. While I do think it’s important not to present misleading numbers, it’s inarguable that the Trumps have profited enormously from World Liberty. With 75% of WLFI token sale proceeds flowing directly to the Trumps after an initial $30 million threshold was met, the Trumps profited $412.5 million from the early token sales. The token has also served as a mechanism for indirect payments to the president and his family — crypto billionaire Justin Sun’s $75 million purchases of WLFI in November 2024 and January 2025 saw $56 million of it flow directly to the Trumps. Besides that, the family has a massive share of WLFI tokens they will later be allowed to sell (though not for $5 billion) or potentially borrow against. And the family maintains an equity stake in the company, giving them a share of all ongoing operations. One significant revenue stream comes from the USD1 stablecoin — particularly its use by the Emirati firm MGX for an investment into Binance [I83]. This arrangement alone is projected to generate $280 million by the end of Trump’s term, with approximately $168 million of it flowing to the Trump family.2](https://media.hachyderm.io/media_attachments/files/115/192/126/425/950/191/original/6231b762efab639e.png)

![WLFI opens for trading

World Liberty Financial’s WLFI token, previously a non-resalable “governance token” available for purchase only by non-US buyers and accredited US investors, has become available for secondary trading following a July governance vote [I88]. After trading opened, the Wall Street Journal ran the headline: “Trump Family Amasses $5 Billion Fortune After Crypto Launch”.1 In the article’s subtitle and body text, the Journal acknowledges that these are merely “paper” profits, quietly walking back the misleading headline figure. Flawed estimates of dollar-denominated windfalls — which ranged from around $4 to $6 billion depending on outlet — are a recurring issue in crypto reporting, as I discussed in my January article “No, Trump didn’t make $50 billion from his memecoin”. For one, the Trumps and other members of the project team are not yet permitted to actually sell any of their tokens. But even if they were, large sales of tokens in low-liquidity markets inevitably cause token prices to collapse, making the price × quantity equation a poor estimate for the dollar value of large holdings. The Trump family faces even further challenges to cashing out: any significant selling of their stash would likely trigger market panic as investors rush to interpret what the insider sales signal.](https://media.hachyderm.io/media_attachments/files/115/192/126/421/378/537/original/4fcbf138dec94565.png)

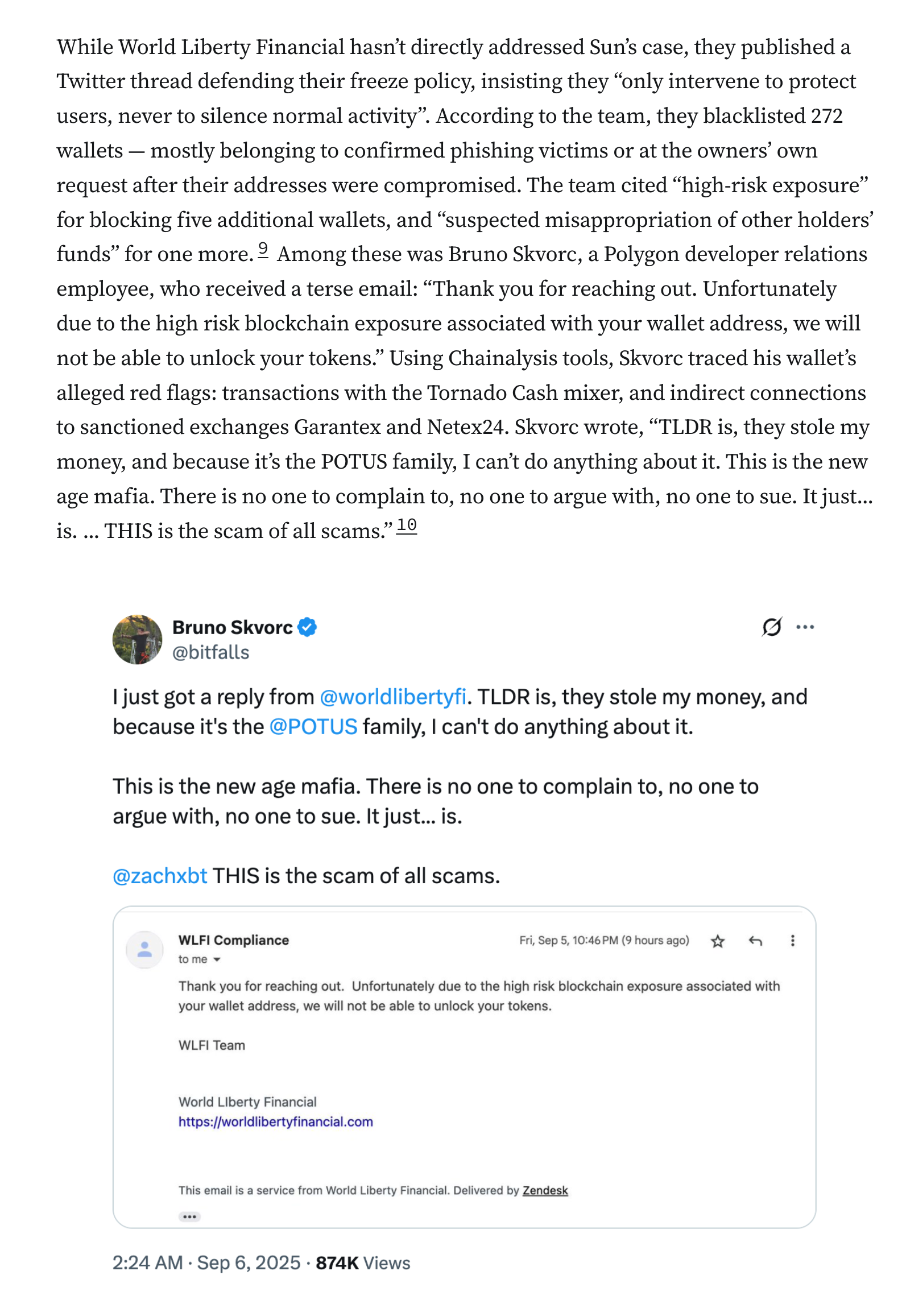

The World Liberty project, which the Trump sons say they created to fight “debanking”, is getting some flak for freezing holders’ tokens — including those belonging to some of their biggest backers, like billionaire Justin Sun.

![Such functions don’t normally exist in more decentralized cryptocurrencies like bitcoin or ether, but are more common in tokens issued by centralized entities who routinely freeze tokens in sanctioned wallets or that are deemed to be associated with thefts or other illicit activity. Sun defended his actions on September 4, tweeting that he had only “carried out a few general exchange deposit tests” and that “no buying or selling was involved”. He insisted these transfers “could not possibly have any impact on the market” — apparently responding to speculation that he had been selling tokens and thus contributing to WLFI’s price decline, though it remains unclear whether this accusation came from the World Liberty team themselves or from public speculation.6

This move by World Liberty Financial stands in stark contrast to the Trump sons’ frequent complaints about being “debanked” by traditional financial institutions who they say arbitrarily denied them loans and services — the very issue they claimed inspired them to create this project. Sun has publicly appealed to the project team, saying his tokens were “unreasonably frozen” and that he “deserve[s] the same rights” as other early buyers. He wrote, “I call on the team to respect these principles, unlock my tokens, and let’s move forward together toward the success of World Liberty Financials [sic].”7 Perhaps in an attempt to mollify the World Liberty Financial team, Sun tweeted the following day that he planned to purchase](https://media.hachyderm.io/media_attachments/files/115/192/129/882/322/669/original/efe755ee4c9a84e8.png)

The Nasdaq has determined that Eric Trump should not serve on the board of ALT5 Sigma, a treasury company that’s set to buy $750 million WLFI tokens, benefiting him and his family to the tune of $500 million. I guess they have to draw the line somewhere.

The Senate published a new discussion draft of their market structure legislation. Senator Warren has issued a statement that the newest proposal “reportedly reflects secret feedback” from the crypto industry that Republicans have refused to share.

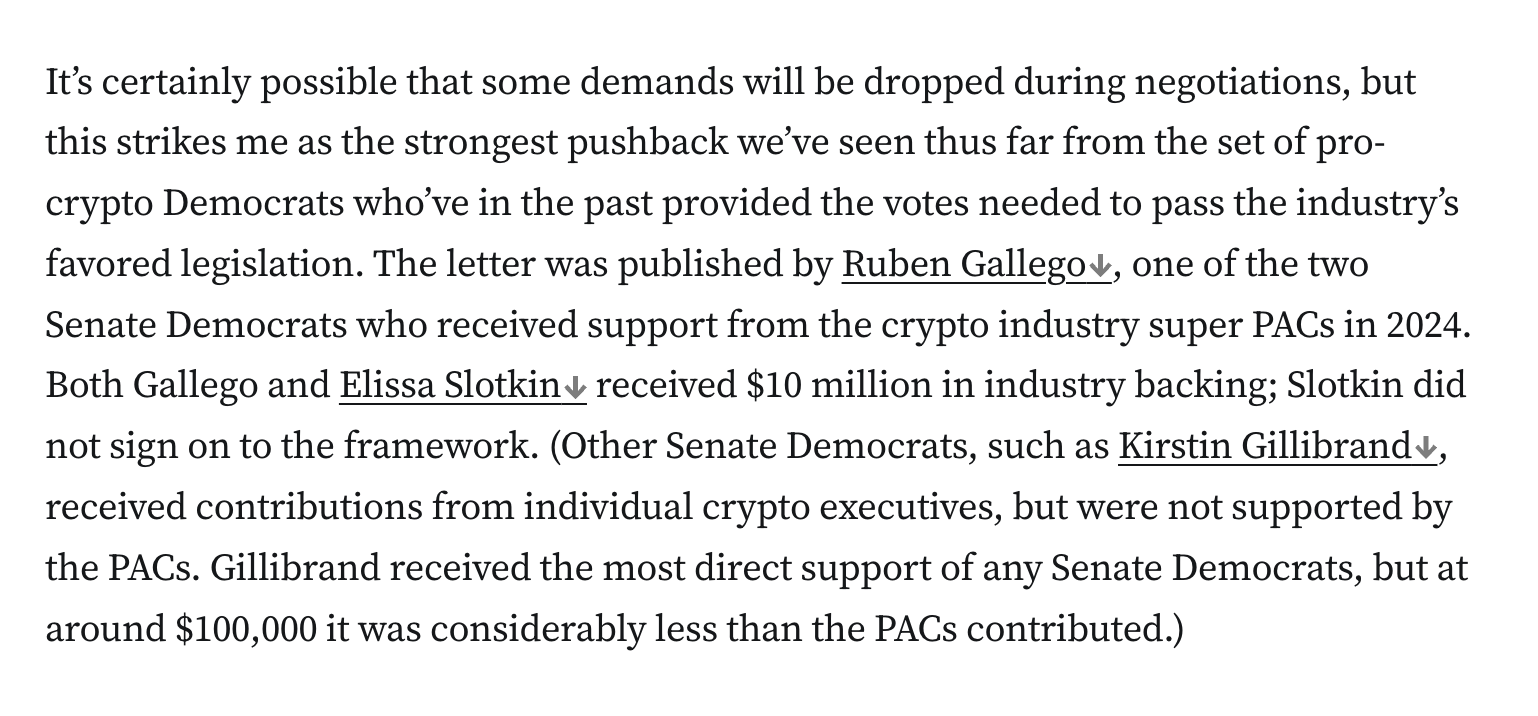

Pro-crypto Senate Democrats have signaled they’re willing to work on a market structure bill, but have made some demands — including a prohibition on elected officials profiting from crypto projects.

Democrats have made these demands in the past, but typically not the ones who have provided the swing votes for crypto legislation. Now, 11 of 18 Senators who voted for GENIUS have signed on to a letter demanding these changes.

And the letter was authored by Ruben Gallego (D-AZ), who received $10 million from the crypto lobby in 2024. It’s certainly possible that some demands will be dropped during negotiations, but this strikes me as the strongest pushback we’ve seen thus far from pro-crypto Senate Dems.

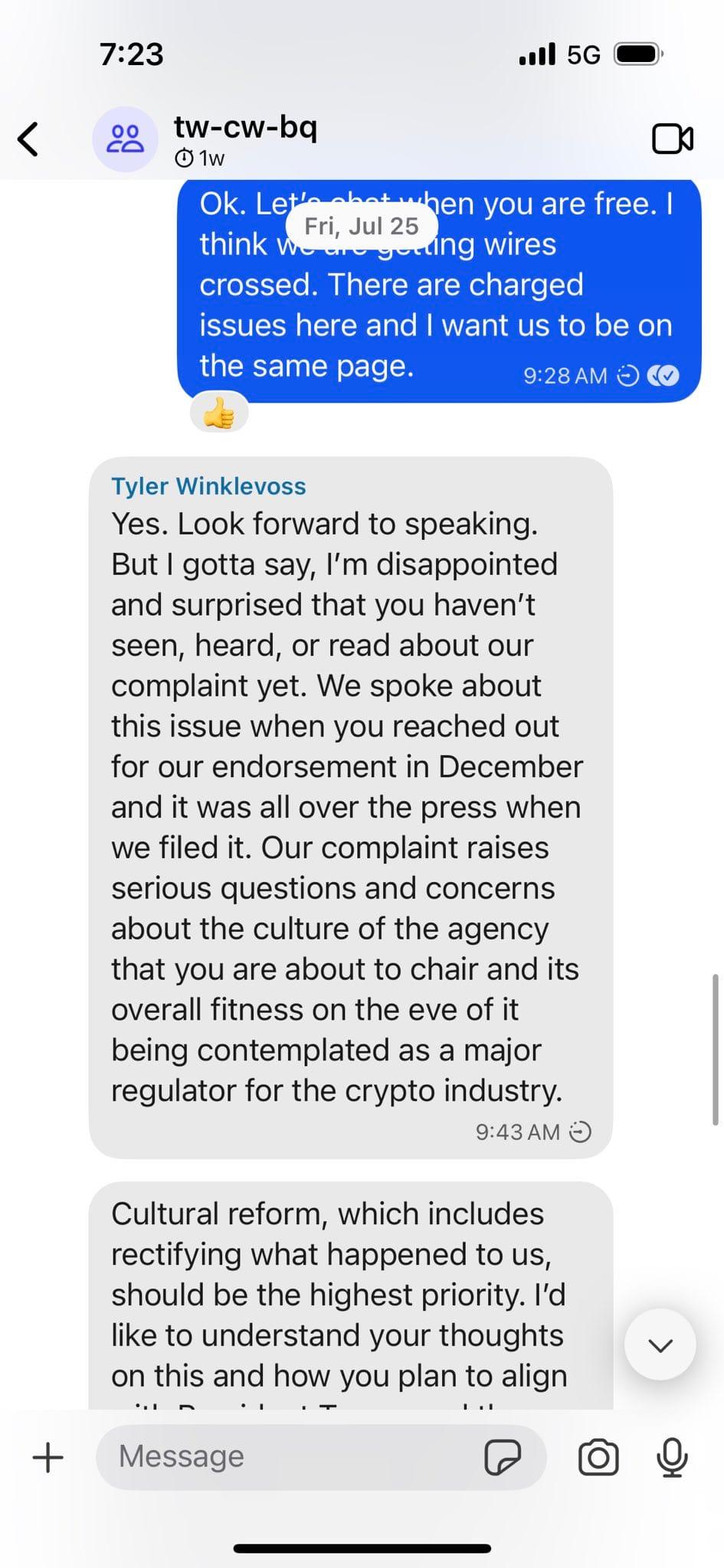

![Democrats’ past objections to the Trump family’s crypto self-enrichment, raised during debates over bills like the Genius Act [I84], have yet to seriously threaten the legislation’s passage. However, these objections were raised most loudly by Democrats not likely to support the legislation anyway — not from the same Democratic Senators who provided the necessary votes to pass Genius. This framework was signed by eleven of the eighteen Democrats who voted for the Genius Act, plus Senator Blunt Rochester, who supported Genius during the cloture stage but switched to a no vote on the bill itself. Seven Democratic Senators who voted for Genius did not sign on to this framework: Fetterman (PA), Hassan (NH), Heinrich (NM), Ossoff (GA), Padilla (CA), Rosen (NV), and Slotkin (MI).

Senator State Voted for Genius cloture Voted for Genius Signed framework letter Alsobrooks MD Y Y Y Blunt Rochester DE Y N Y Booker NJ Y Y Y Cortez Masto NV Y Y Y Fetterman PA Y Y N Gallego AZ Y Y Y Gillibrand NY Y Y Y Hassan NH Y Y N Heinrich NM Y Y N Hickenlooper CO N Y Y Kim NJ N Y Y Lujan NM Y Y Y Ossoff GA Y Y N Padilla CA Y Y N Rosen NV Y Y N Schiff CA Y Y Y Slotkin MI Y Y N Warner VA Y Y Y Warnock GA N Y Y](https://media.hachyderm.io/media_attachments/files/115/192/150/588/068/373/original/5f8f241641563842.png)

![The pro-crypto wing of the Senate Democrats has indicated willingness to negotiate a market structure bill, but suggested they will not sign off on one without some conditions. This is both good and bad for the crypto industry: on the one hand, they may get a bill through before the midterm elections, which is priority number one for an industry nervous that the Republican trifecta may not survive past 2026, and wants to see a bill signed into law so that the industry’s “progress” cannot be so easily rolled back. On the other hand, the Democrats are asking for more significant changes than they demanded in negotiations over the Genius Act — some of which could be stumbling blocks if the Democrats stick to their guns.

These include things like amendments to the draft regulation to ensure that the SEC and CFTC have the authority and funding to oversee crypto markets without leaving any assets in a regulatory vacuum, and strengthening consumer protections (including by preserving state regulatory and CFPB authorityb). They also want to see elected officials and their families prohibited from “issuing, endorsing, or profiting from digital assets while in office”, and require disclosures from officials who hold digital assets. They demand that “commissioners from both parties sit at the SEC and CFTC to create a quorum for digital asset rulemakings”, seemingly addressing the concern that Trump will leave the CFTC as a one-man agency [I91].15](https://media.hachyderm.io/media_attachments/files/115/192/150/582/946/415/original/06643bf77b70793b.png)

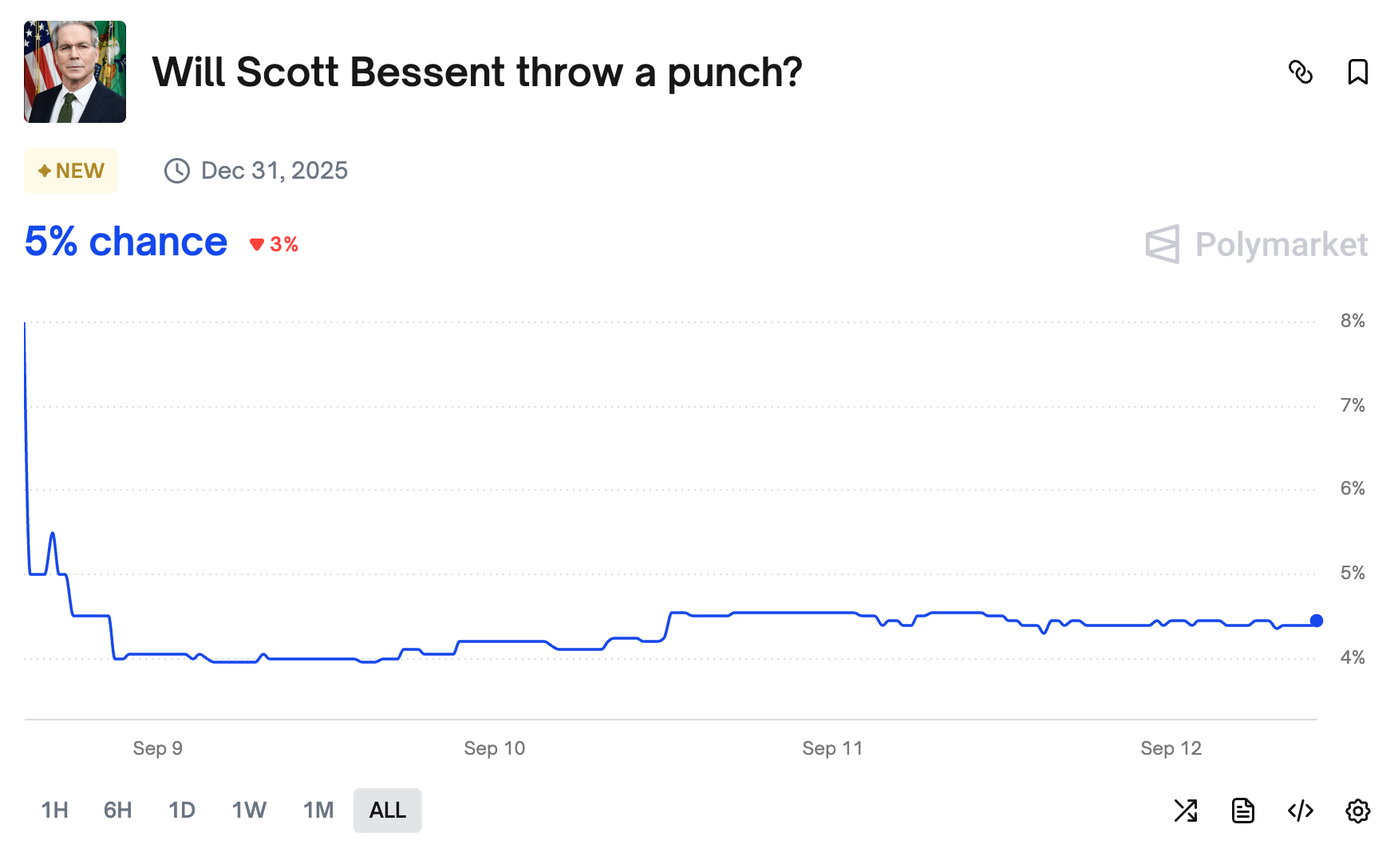

The CFTC has issued a no-action letter greenlighting Polymarket to start opening up to US customers. Thank goodness: in the future, when Treasury Sec Scott Bessent threatens to punch FHFA director Bill Pulte in the face, US speculators will be able to gamble on the likelihood that Bessent actually throws a punch.

![In regulators

The CFTC has issued a no-action letter with respect to QCX, the tiny derivatives exchange Polymarket acquired in July to get their hands on its Designated Contract Markets (DCM) license [I89].16 This essentially gives Polymarket the okay to begin offering their prediction markets in the US — though given how many Americans already trade on the platform despite its supposed prohibitions, more than a few people were surprised to learn they even needed such approval. Prediction markets were once a rare phenomenon in the US — or strictly limited academic exercises — thanks to CFTC oversight that prohibited platforms from offering the types of sports, elections, and current events contracts that are now popular. Now even the academic exercise (a non-profit platform called PredictIt) will be expanding its US operations with a recent okay from the CFTC.17

Heavy pressure from these platforms in and outside of court, a favorable court ruling [I66], and new CFTC leadership that thinks these platforms are “an important new frontier”18 has resulted in this explosion of places where people can bet (sorry, trade) on everything from who will win an election or sports game, to what words public officials will use in speeches, to which countries will airstrike one another. Now when Treasury Secretary Scott Bessent threatens to punch Federal Housing Finance Agency director Bill Pulte in the face,19 speculators can gamble on the likelihood that Bessent actually throws a punch (tr](https://media.hachyderm.io/media_attachments/files/115/192/170/600/006/934/original/8728d7362e5a6ded.png)

A space for Bonfire maintainers and contributors to communicate