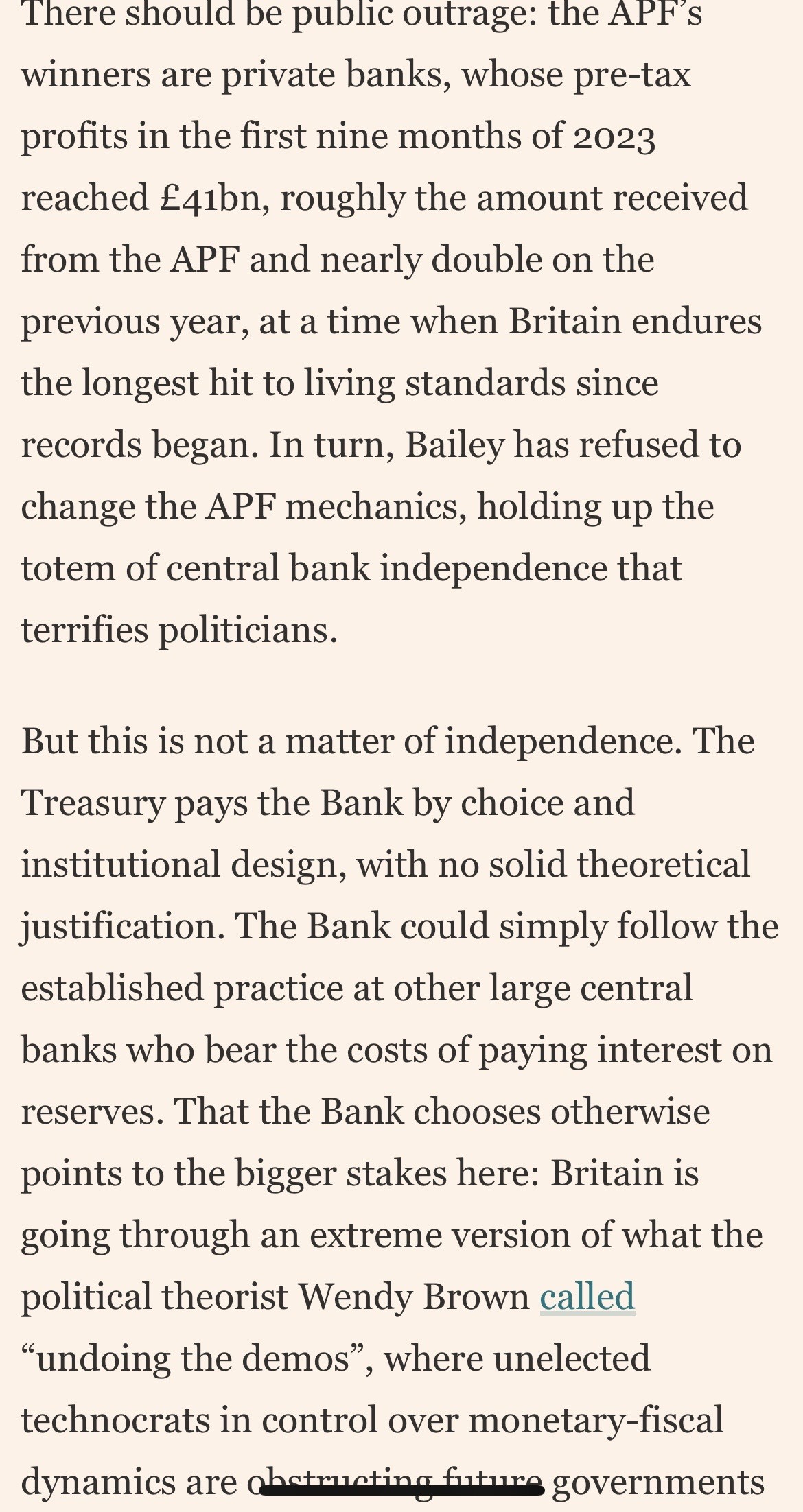

But fiscal space is a political construct, as Liz

Truss painfully learnt. Who you tax, how and

what you spend, and how you defend yourself

against the bond vigilantes policing your

moves are all political choices, informed by

ideological visions and constrained by

institutional set-ups. The Bank of England's

role is rarely visible, by design.

The Bank is supposed to stay out of fiscal

affairs. Yet its invisible hand is now depleting

the Treasury coffers to boost commercial bank

profits. This is the consequence of the

institutional arrangement for quantitative

easing, through the Asset Purchase Facility

(APF) run by the Bank of England. Unique in

the world, the APF has cost the UK Treasury

around £38bn in 2023 and a projected £40bn

in 2024. The Bank of England has projected

that under the "optimistic scenario, the

Treasury will pay the APF around 110bn

throughout a 2025-2030 government, and net

costs could reach £230bn by 2033, beyond

Labour's wildest green spending dreams.