Some pro-crypto Democrats have become angry with crypto executives who have been in Washington lobbying for their preferred legislation, accusing them of being “an arm of the Republican Party”.

Discussion

@molly0xfff your work is awesome, enraging, depressing, and super interesting all at the same time. keep it up. <3

Some pro-crypto Democrats have become angry with crypto executives who have been in Washington lobbying for their preferred legislation, accusing them of being “an arm of the Republican Party”.

@molly0xfff I'm tempted to mock Gallego for not foreseeing this when he got in bed with the crypto lobby, but then, I'm the chump who believed he was a genuine progressive, so what do I know?

The Trump administration is vetting possible pro-crypto candidates for Fed Chair. The list reportedly includes an ex-Coinbase councilmember and current shareholder, and someone who thinks the Fed is “overly cautious” and should allow Fed staff to hold crypto.

@molly0xfff jfc... OMG this is going to get a whole lot worse before it gets better

The OCC’s Jonathan Gould suggests part of the reason they approved the Thiel-backed Erebor’s application was to rebut “debanking” accusations. It’s like approving a bridge design because the engineers accused you of being anti-infrastructure — never mind the last one collapsed into the river.

@molly0xfff crypto tentacles in normie banking system is so worrying. What’s the best way to decrease exposure? I’m wondering if there’s any banks that can say they don’t have exposure

Nevada just shut down the allegedly insolvent crypto custodian Fortress Trust, only a few years after shutting down an insolvent crypto trust company founded by the same guy. Earlier this month, the SEC greenlighted allowing such firms to custody crypto.

@molly0xfff So much BAD LUCK for that one guy. How he keeps losing other people's millions. Just tragic. Should we send him thoughts and prayers?

@molly0xfff the amount of carelessness (and i'm being nice) tolerated in the crypto industry never cease to amaze.

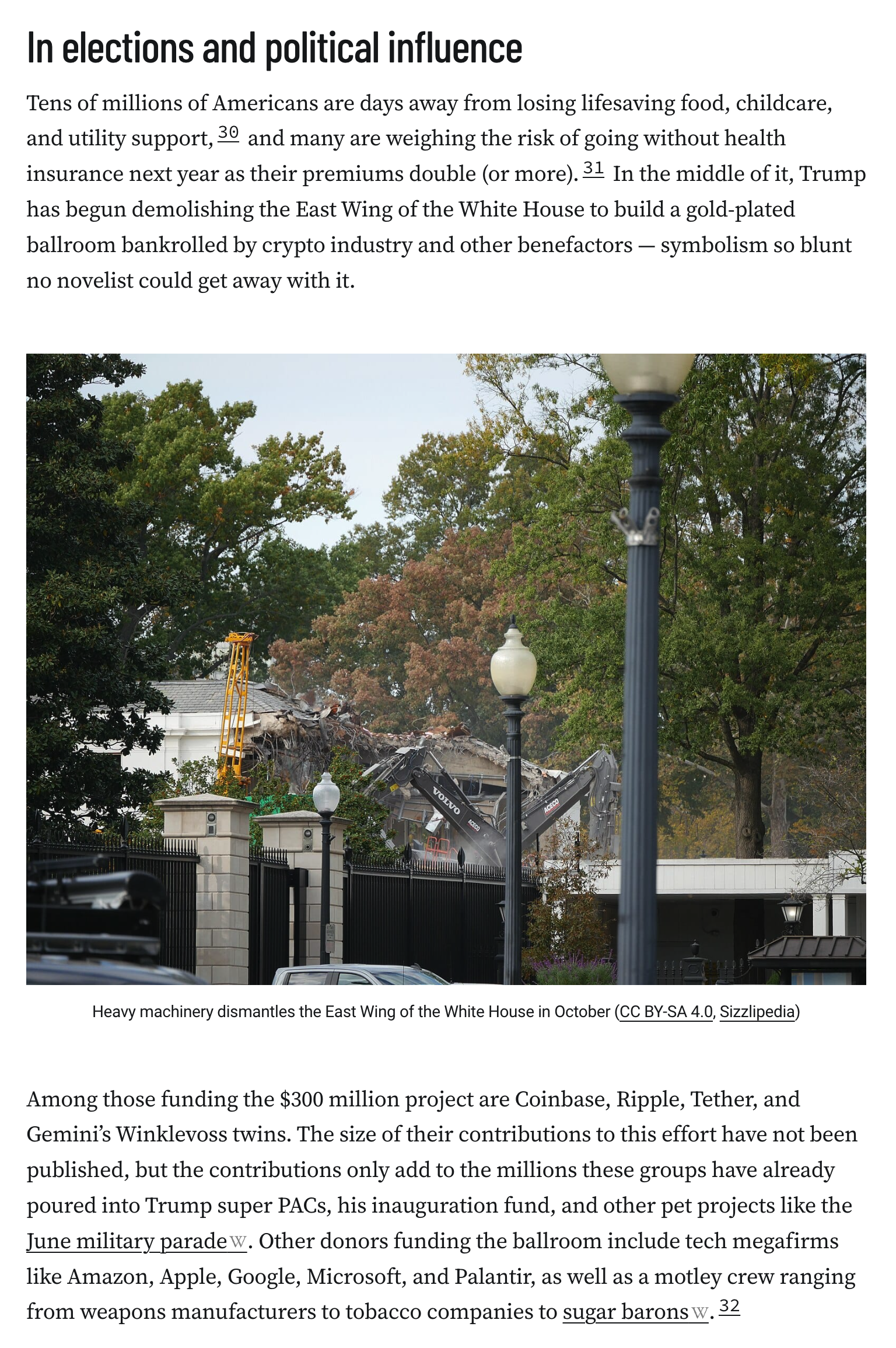

Gemini’s Winklevoss twins and the crypto firms Coinbase, Ripple, and Tether are among those bankrolling Trump’s $300 million ballroom project. This only adds to the millions they’ve already poured into Trump super PACs, his inauguration fund, and other pet projects like the June military parade

@molly0xfff oh, is the secure connected basement now going to be used for mining?

Is it wrong of me to think some of those crypto funds are bribes coming from Russia's Putin and North Korea's Kim?

bonfire.cafe

A space for Bonfire maintainers and contributors to communicate

![Some pro-crypto Senate Democrats have reportedly blown up at the crypto executives in these meetings, urging them: “Don’t be an arm of the Republican Party — they used you and your megaphones to fuck us.”15 This was likely in response to the recent leak by Senate Republicans of a Democratic draft proposal to regulate decentralized finance, which sparked dramatic backlash from crypto industry figures who fear it would effectively outlaw defi. Paradigm lobbyist Alexander Grieve bashed the proposal as “worse than anything Gensler cooked up”,16 and industry advocate Jake Chervinsky described it as “basically a crypto ban”.17

Other Democrats have expressed annoyance at Republicans for pushing them to agree to a markup date without having had much time to negotiate the draft. “Democrats have shown up ready to work but our Republican counterparts are crashing out,” said a staffer for Arizona Senator Ruben Gallego. “Their demand to set a markup date before text is agreed to is like setting a wedding date before the first date. It’s nonsensical.”18 But the Republicans are feeling the time crunch. A source familiar with the meetings, speaking to Decrypt, said, “[T]he Republicans are like: ‘If we don't move this in November, we don't get it done by the end of the year, then the whole thing derails.’”19](https://media.hachyderm.io/media_attachments/files/115/453/994/661/740/441/original/1ffbb2bd30ce3521.png)

![Meanwhile, the Office of the Comptroller of the Currency is sifting through a growing pile of applications for national trust bank charters from cryptocurrency firms. Circle, Ripple, BitGo, and Erebor applied for theirs earlier this year [I88], and Paxos followed not long after. This month, Coinbase, Stripe’s recently acquired stablecoin firm Bridge, and Crypto.com have all added their applications to the stack. Erebor’s is the first application of the lot to be granted preliminary approval. As I wrote in July:

Another bank called Erebor, which as you might guess by the Lord of the Rings name is backed by Peter Thiel, Joe Lonsdale, and Palmer Luckey, has also applied for a bank charter. According to the Financial Times, the new bank will aim to “fill the gap left by Silicon Valley Bank” — the tech startup-focused bank that failed in March 2023. Around 85% of Silicon Valley Bank’s deposits, mostly belonging to venture capitalists and venture-backed tech companies, were uninsured; the FDIC nevertheless covered those uninsured depositors and spent $20 billion on the whole boondoggle. As is so often the case with “tech visionaries”, yesterday’s warning lesson is tomorrow’s blueprint.

A statement by Comptroller Jonathan Gould suggests that the approval was at least partially motivated by a desire to cast off accusations from the crypto industry that government agencies had targeted it for “debanking”. In a statement, Gould announced that the approval “is also proof that the OCC u](https://media.hachyderm.io/media_attachments/files/115/454/000/840/660/451/original/140c9289e167a401.png)

![In the states

Nevada’s Financial Institutions Division (NFID) has issued a cease and desist order against Fortress Trust [W3IGG], a crypto custody company founded by Scott Purcell. Purcell had previously founded Prime Trust, which filed for bankruptcy in 2021 after raising tens of millions in seed funding, giving half of it to executives, and then promptly losing a hardware wallet storing customer funds [I31, 38]. The company’s bankruptcy filing came only after the firm was placed into receivership by NFID, which alleged they were insolvent and ordered them to halt operations.

Now, NFID is ordering Fortress Trust to halt operations because — you guessed it — Fortress is “on the verge of insolvency”. NFID elaborates that Fortress has about $1.3 million in custodial assets, but they owe clients around $12.3 million; and have acknowledged that they “failed to safeguard assets under its custody and is unable to meet all customer withdrawals”. (I’m not quite sure why NFID describes this as merely “on the verge” of insolvency.)29 Fortress previously made it to this newsletter in September 2023 after suffering a $15 million theft. At the time, Fortress announced it would be acquired by Ripple, which had agreed to cover the losses; however, the deal fell through later that month [I39, W3IGG]. It’s not clear how — or if — Fortress ever plugged that hole.

Fortress is a state-chartered trust company — the very same category of company that the SEC just greenlighted to serve as crypto](https://media.hachyderm.io/media_attachments/files/115/454/004/647/251/173/original/6b08fa7fb02ecad0.png)