Institutions lost the most in terms of dollars, but the true extent of the damage may be slow to appear. Binance’s hastily implemented $100 million institutional bail-out program suggests things may be worse underneath the surface.

Discussion

@molly0xfff Crypto bros who voted for tRump are you winng yet?

good let's get that over with so we can move on to the AI crash and burn

... this time, I'm DEFINITELY buying #BTC when it hits $20,000 again!!!

@molly0xfff

So I guess for me crypto is one magnetic pulse away from oblivion. Something thing that has no intrinsic value. Value giving to it by those controlling it. What could go wrong

…..lol best to stay away. #crypto

@molly0xfff Terminology question.

When you talk about bringing in liquidity, is that when some institutions use hard fiat cash (USD I assume) to buy up from the excess of sellers in the market to try to stabilize prices?

@virtuous_sloth If you’re asking about market makers, they’re often simultaneously and rapidly both buying and selling — basically stepping in to match open orders if there aren’t other traders available.

After the crash, new money likely did come in also — “dry powder” from institutions looking to buy the dip.

@molly0xfff

Pleasant to hope the Trump brothers lost their crypto stake.

@molly0xfff Wait… are they suggesting that imaginary internet “money” might have no real value???

Crypto’s October 10 flash crash, following a Trump social media post threatening severe tariffs on China, caused $19 billion in liquidations. It’s a signal that the market most eager to be taken seriously may also be the one least equipped to handle real-world shocks.

@molly0xfff nice. May it all crash and burn.

It all started when Trump’s threat to further increase tariffs on China by 100% caused traders to panic sell crypto, with some fleeing for safer assets like Treasury bills and gold.

Bitcoin plummeted 10% in the span of minutes, and other tokens were even harder hit. Altcoins like Solana plunged 40%, and Trump’s own memecoin dipped more than 60%.

Volatility only increased as market makers withdrew. Some accused these institutions abandoning their responsibility during a critical time, while others reasoned that they have no regulatory or other mandate to stabilize markets — potentially at their own expense.

![Crypto’s generally illiquid markets contributed to the price volatility. CoinDesk reported that “market depth collapsed by more than 80% across major exchanges within minutes.”3 Market makers — institutions that normally provide liquidity and price stability by taking the opposite side of trades — came under fire as some accused them of amplifying the crash by withdrawing liquidity during this crucial period. The Coinwatch crypto tracking platform accused market makers of “desert[ing] their responsibility”,4 and blockchain analyst YQ alleged “they executed a coordinated withdrawal at the optimal moment to minimize their losses while maximizing subsequent opportunities.”5 Others characterized these institutions’ pullback as a normal risk management response to elevated volatility, and the predictable actions of firms with no mandate to maintain market stability at the expense of their trading books. Regardless of the reason, the severe lack of market depth resulted in extreme price dislocations across exchanges. On Binance, the Cosmos token momentarily appeared to plummet in value from $3.90 to a tenth of a cent.](https://media.hachyderm.io/media_attachments/files/115/391/603/259/896/059/original/5b364785efae8a18.png)

@molly0xfff

-Our currency need no institutions! WAAAH SAVE MY PROFITS!

As trading activity spiked, exchanges went down or suffered outages that prevented people from placing trades or shoring up their positions. Binance, Coinbase, Kraken, Robinhood, and several other major platforms were all reported to experience significant service interruptions.

![Some have accused centralized exchanges of minimizing their own losses at their customers’ expense by intentionally halting trading or withdrawals under the guise of “technical difficulties”. Indeed, it is suspiciously common for supposedly highly sophisticated centralized exchanges to suddenly experience glitches or announce urgent “maintenance” under far less volatile circumstances. Kris Marszalek, founder of the Crypto.com centralized exchange, was among the most prominent to repeat this allegation, tweeting that regulators should investigate rival exchanges to determine if any “slow[ed] down to a halt, effectively not allowing people to trade”.6](https://media.hachyderm.io/media_attachments/files/115/391/610/467/231/273/original/cac2f004281ff652.png)

@molly0xfff Headline: "CORRUPT CRAPTO CRASHES!" Bubble busts leaving global stench...

But the biggest factor in the meltdown was leverage. As prices dropped, leveraged positions were forcibly liquidated. This contributed to sell pressure, causing prices to go lower, triggering more liquidations. A classic crypto “death spiral”.

Cascading liquidations were worsened by crypto exchange glitches which left some customers watching helplessly as stop-losses failed to trigger or trades to add more collateral to at-risk positions failed to execute.

Though leverage is not unique to crypto, some things are: the extremely high leverage offered by some platforms (100x or more), the ability to use highly volatile cryptoassets as collateral, the speed at which positions can unwind, and limited requirements for position monitoring or risk management.

@molly0xfff is there any data on margin secured by NVIDIA/Meta/Google used to buy cryptocurrency?

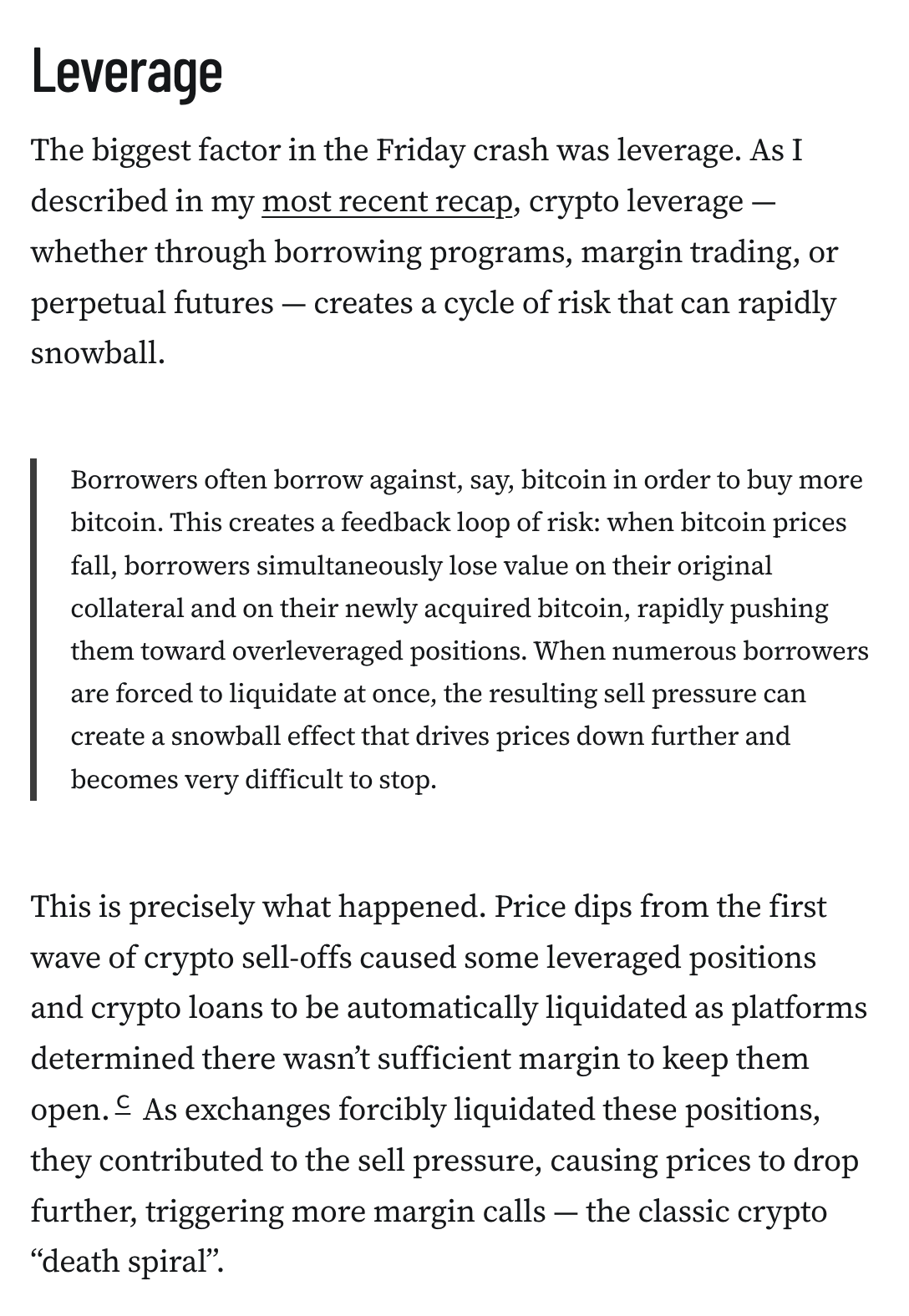

A practice called auto-deleveraging likely saved some exchanges from accumulating huge amounts of bad debt, but it also likely slowed recovery by thinning liquidity even further — and it increased the nerves of traders who saw even profitable positions unwound.

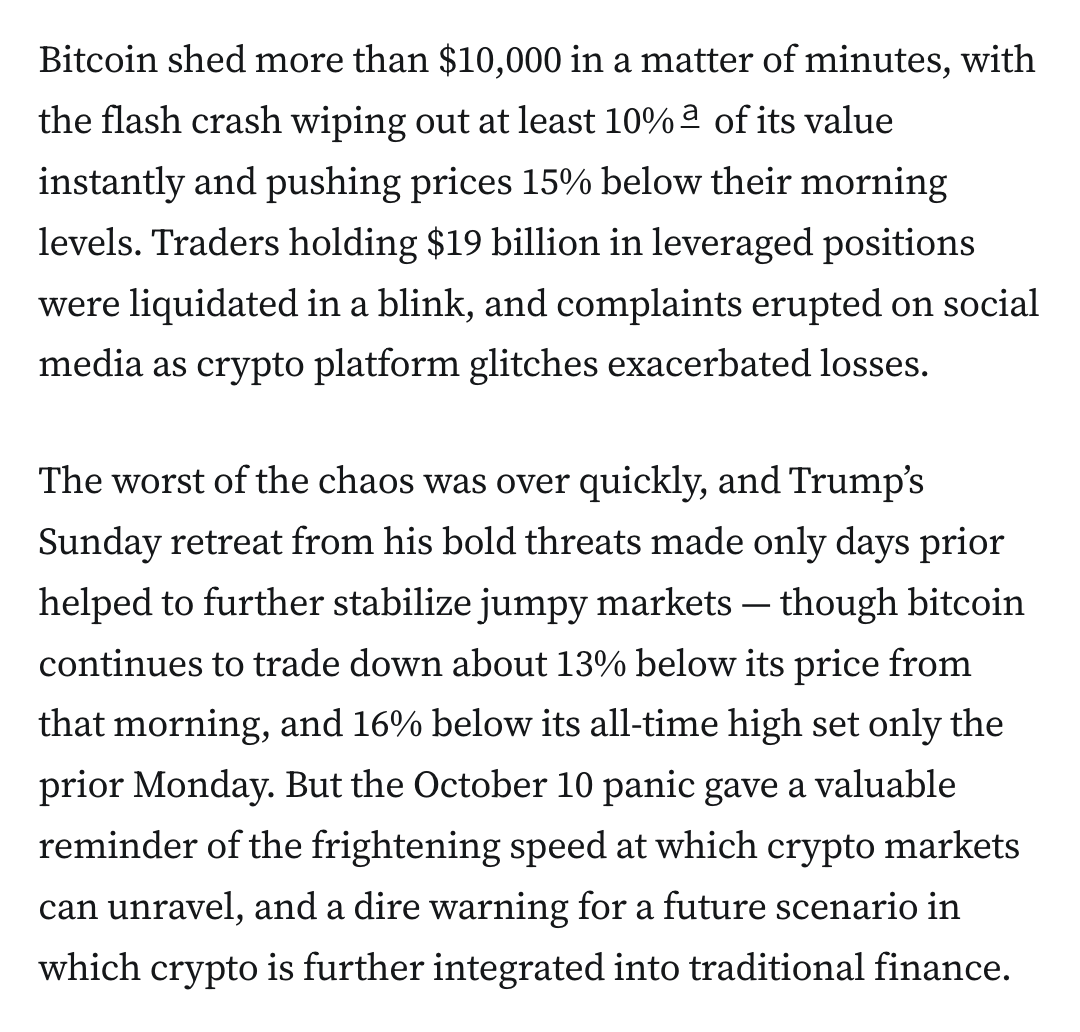

![During this crypto crash, exchanges began to blow through their insurance funds. Binance, for example, dipped into its insurance fund to the tune of around $188 million over just that one day.

A chart showing an insurance fund balance of around 1.2–1.25 billion, dropping to below $1.05 billion on October 10

Binance’s claimed insurance fund balance (Binance, geofenced)

And so multiple platforms resorted to auto-deleveraging. Among them was Hyperliquid, a buzzy defi trading platform, whose founder stated that “this was Hyperliquid’s first cross-margin ADL in more than 2 years of operation” and that “billions of dollars worth of positions [were] liquidated on Hyperliquid in a matter of minutes.”9 This helped stop the bleeding somewhat, and likely saved some exchanges from collapse. However, the early closures of short positions also removed even more orders from order books, thinning liquidity even further and potentially making it harder for markets to stabilize.](https://media.hachyderm.io/media_attachments/files/115/391/630/934/447/871/original/a676d303956901b6.png)

In the chaos, one trader profited ~$150 million from well-timed shorts. With an offshore crypto trading platform, potentially offshore trader, and no regulators apparently interested in crypto enforcement, the possibility that someone was trading on White House inside info will likely go unexamined.

![Insider trading allegations

In the aftermath, analysts noticed a wallet that had deposited millions into the Hyperliquid decentralized exchange before the crash, taking a heavily leveraged short position on bitcoin and ether. When the market plummeted, they profited to the tune of more than $150 million. The remarkable timing led some researchers and institutions to question whether the trader had inside information from the White House about upcoming tariff announcements, and the blockchain analytics company Arkham labeled the wallet “Trump insider whale” on their platform.10

Some researchers suggested that the wallet might belong to Garrett Jin, the former CEO of BitForex, a Hong Kong-based exchange that shut down in early 2024 amid exit-scam allegations [W3IGG]. Without initially addressing whether he controlled the wallet, Jin posted to Twitter that “I have no connection with the Trump family or Donald Trump Jr. — this isn’t insider trading”, but then later deleted the tweet. Other crypto sleuths have questioned whether Jin really controlled the wallet or is merely connected to the person who does.11 Jin later tweeted, “The fund isn’t mine — it’s my clients’.”12](https://media.hachyderm.io/media_attachments/files/115/391/635/107/529/814/original/5eb105326a0528cc.png)

bonfire.cafe

A space for Bonfire maintainers and contributors to communicate