Jonathan Nitzan and Shimshon Bichler are a pair of anarchist economists whose work I’ve plugged before. Their approach to capitalism draws on Marx’s previous work, but rejects his labor theory of value and concept of socially necessary labor time as ways of explaining capitalist exploitation of labor.

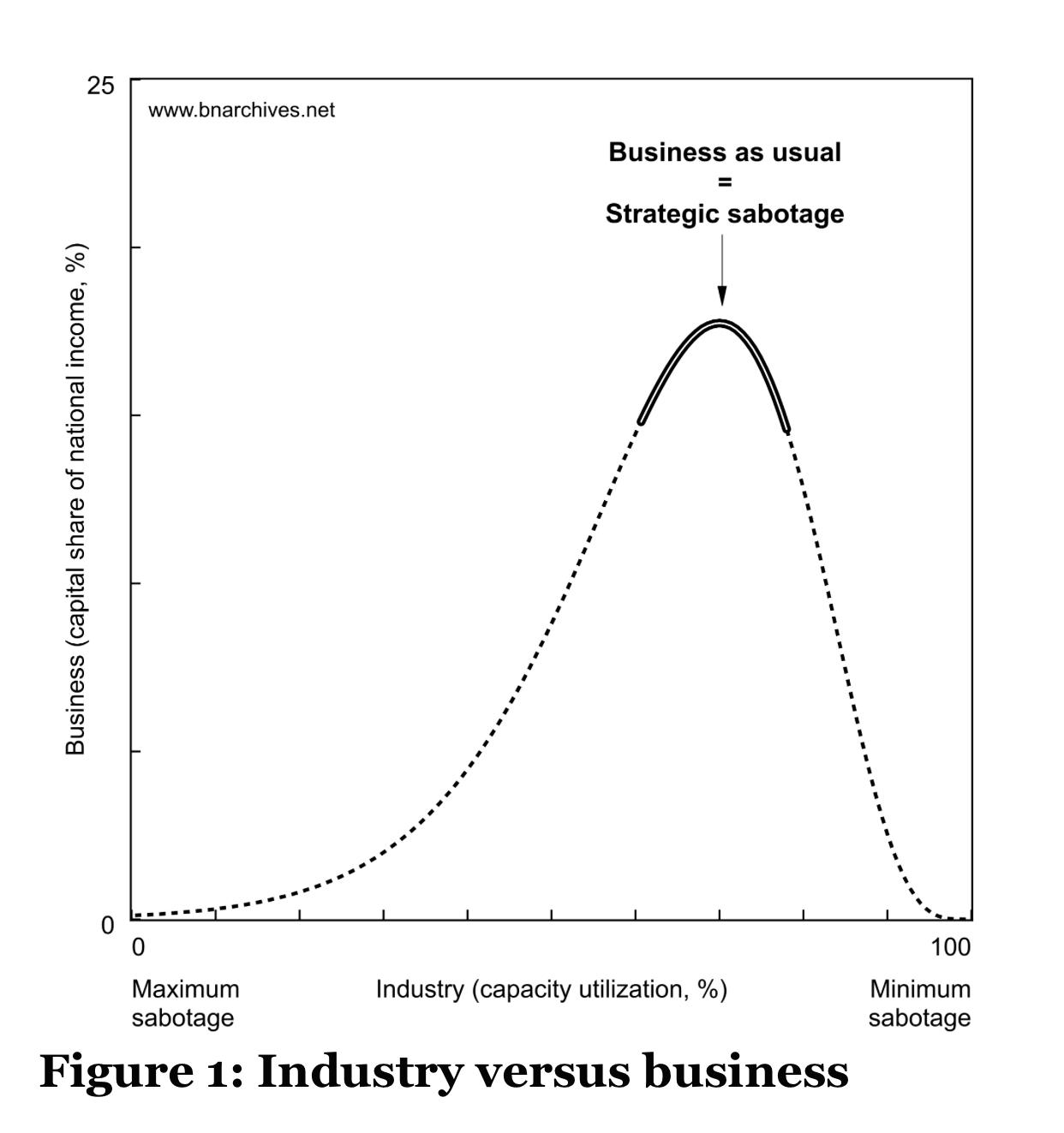

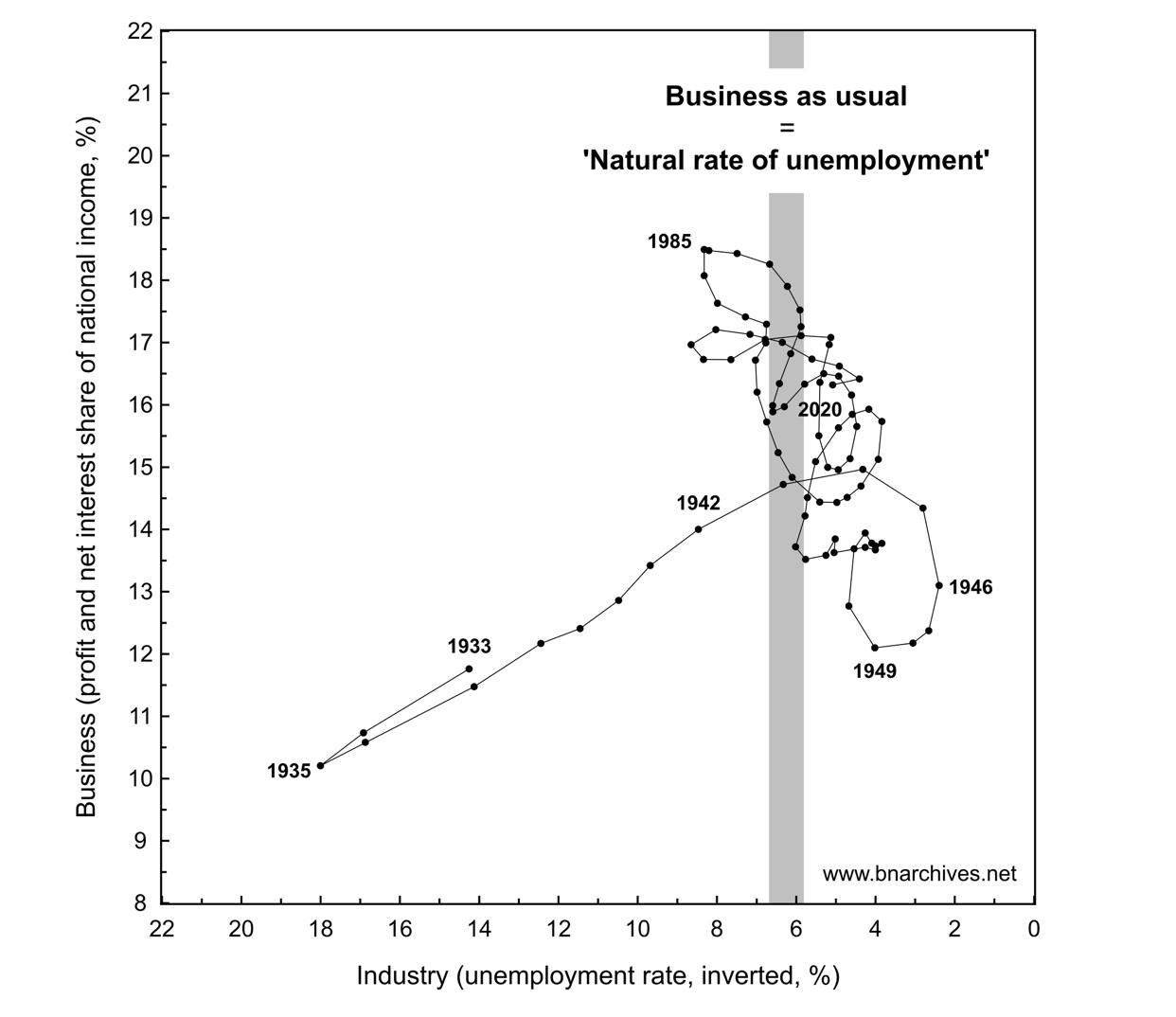

Instead, their work draws on Thorstein Veblen’s concept of industrial sabotage to explain exploitation. Capitalists are not just unnecessary for production, the argument goes, but actively hostile to it, because they can only collect income by threatening to interfere with, or to sabotage, production.

1/4