Relatively wealthy people obviously tend to be the biggest borrowers anyway. Banks generally only lend to people that already have the means to repay.

@ChrisMayLA6 I'm curious about the business models that lead to some of this.

A few years ago, we got some awnings installed on our house. The company offered interest-free credit. There was no down side to taking this (pay 1/3 up front, and then 1/3 each year in monthly instalments over the next 24 months and you pay the same amount in total as paying all of it up front). Keeping the money meant I might earn interest on it, and at least meant I had some more emergency flexibility, so I took that option.

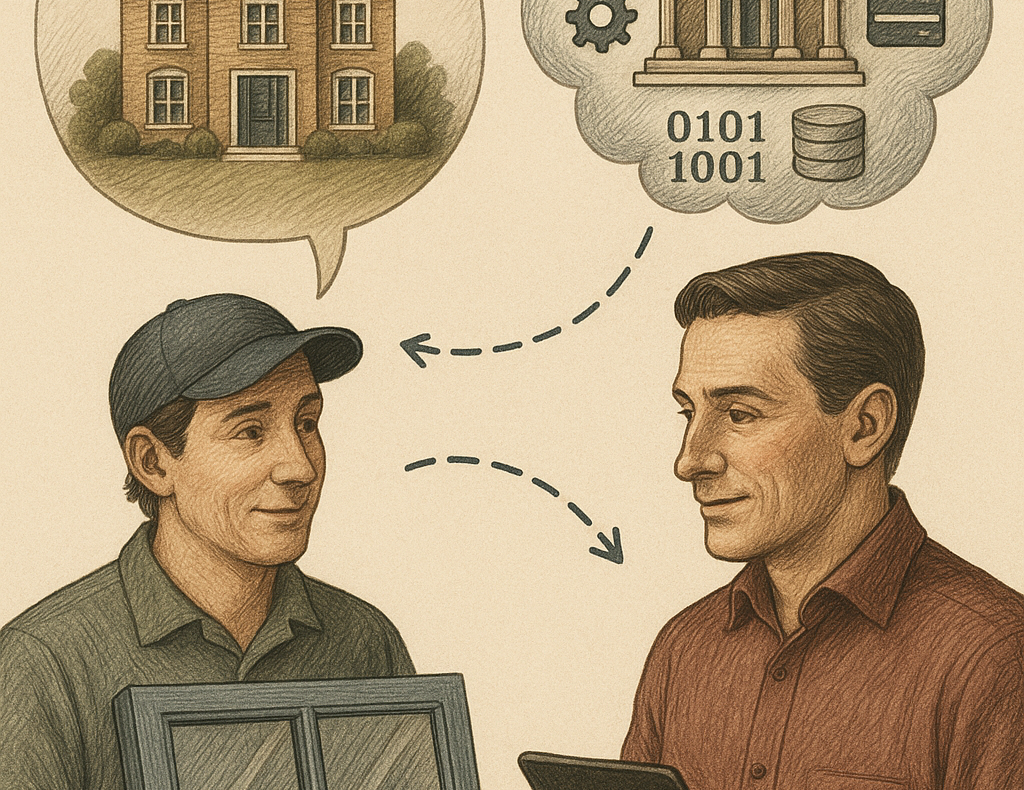

But the thing that surprised me when I agreed was that this was actually done via a third-party company that offered the loan. I don't see how this works. If they charge companies, not taking the interest-free loan option should be cheaper (it wasn't). Do they make money when people default and have to repay with interest more slowly? Do enough people default who are still able to pay back the capital with interest relative to the ones that go bankrupt or pay back without interest to make this worthwhile? It seemed very odd.

I was a little nervous about the impact this additional debt would have on my credit rating when I quit my job and was unpaid for a bit setting up a startup, but it didn't seem to make any difference (at least with Experian).

@david_chisnall @ChrisMayLA6

This kind of explains this sort of scenario I think:

https://www.bitsaboutmoney.com/archive/window-modern-loan-origination/

The loan company as you say makes some money from defaults, but the main thing is via a charge to the supplier - this is a bit like the credit card charge but a bit more.... the key thing for the supplier is they get the money, without taking the risk of handling the loan. Essentially its treated as marketing cost by the supplier.

@ChrisMayLA6 @david_chisnall I once bought a whole brand new car with an interest free loan, which as far as I could work out was genuine. What I haven't worked out is why the dealer tried so hard to persuade me to take it when I'd already indicated that I was willing to pay cash.

I guess the economists', and the wealthy's prejudice against public debt, and in favour of private debt, is influenced by an underlying misconception, and an undoubted fact...

The misconception is that money created in the private banking sector goes into 'investment' (factcheck: it doesn't, it goes mainly to inflate asset values); and that money created by the government is just spent, badly (factcheck: it isn't, it is invested mainly into things like the education, health and safety of us all).

The undoubted fact is that money created in the private banking sector goes mainly to the already wealthy...

This is so clear and helpful. Thank you.

Exactly... and boosted (thanks for the extra commentary)

@ChrisMayLA6 Wow, Switzerland surprises me more than Italy comes as no surprise at all.

I did wonder whether the Swiss figure might be actually linked to rich household's tax planning?

@ChrisMayLA6 Maybe, I really have no idea. But I’d love to know why. I can ask a few people I know and see what an LLM has to say on the subject too.

Relatively wealthy people obviously tend to be the biggest borrowers anyway. Banks generally only lend to people that already have the means to repay.

@GeofCox @ChrisMayLA6 Good point. Am wondering whether it’s the massive borrowings of the super rich which are distorting the total in Switzerland. Remove those and the level of borrowing per head may fall to a more reasonable level.

@GeofCox

For many years I subsisted largely on small research grants that weren't taxed, and so weren't visible as an income source for my credit rating. When the time came to get a house mortgage, there was absolutely no way for me. Except that my rich dad offered to put his name on the loan.

He never paid anything. But thanks to generational wealth, I got to live in a house of my own instead of a rental apartment.

And it was way cheaper too.

One of my daughters lives in the UK (North Wales) and has just bought a house. She had tremendous trouble getting a mortgage because she had no credit rating - never borrowed, never even had a credit card.

In the end, Nationwide, a building society, came through. Building societies do not create money - they really lend out their savers' money (as most people think banks do). I wonder if this 'moral hazard' influences their more sensible lending policies ?