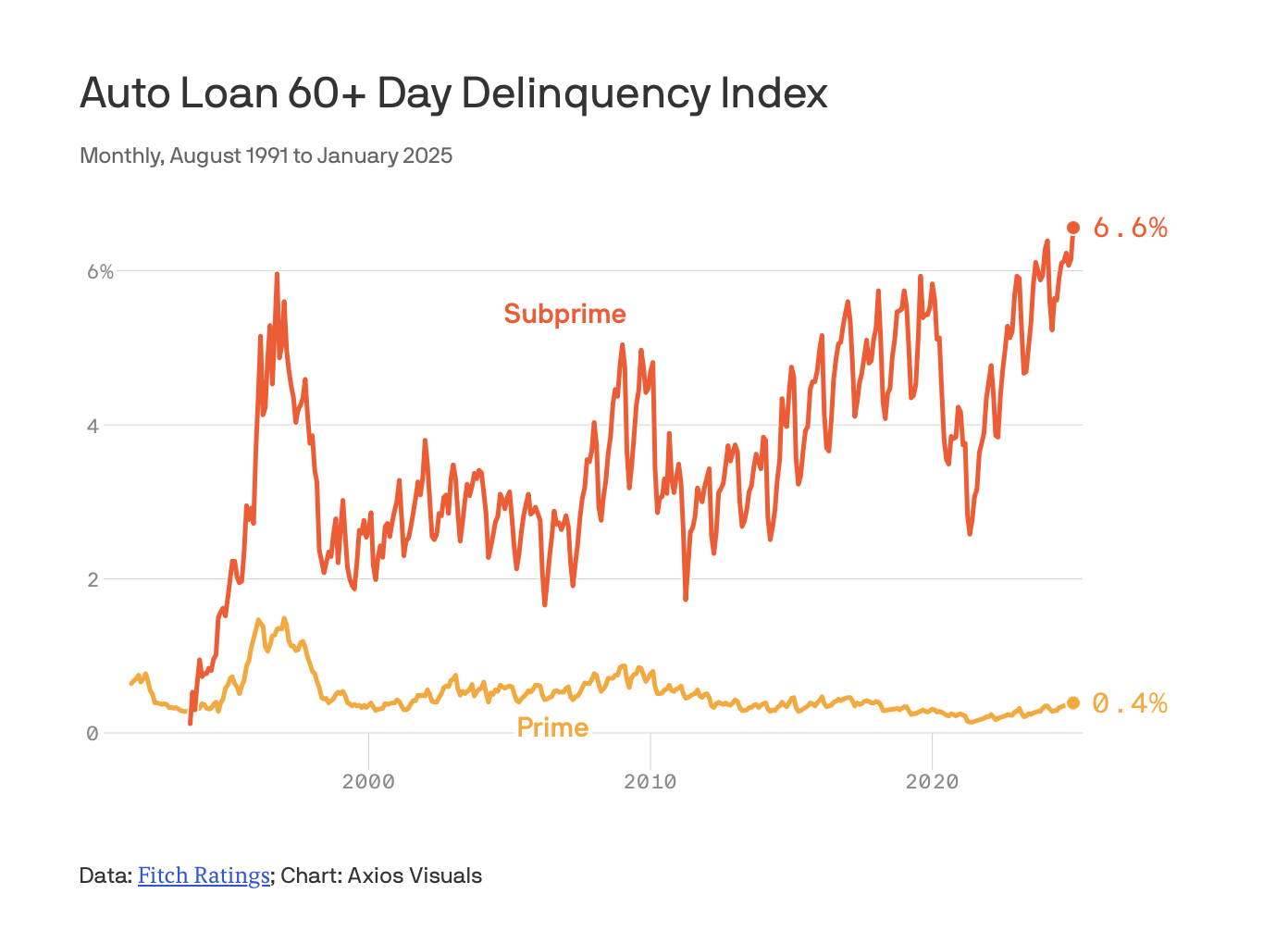

Car-payment delinquency rates have been rising at an alarming rate. 5.1% of US auto loan holders are now delinquent. 1% are 60 days late, and another 1% are 90+ days late. That’s really high.

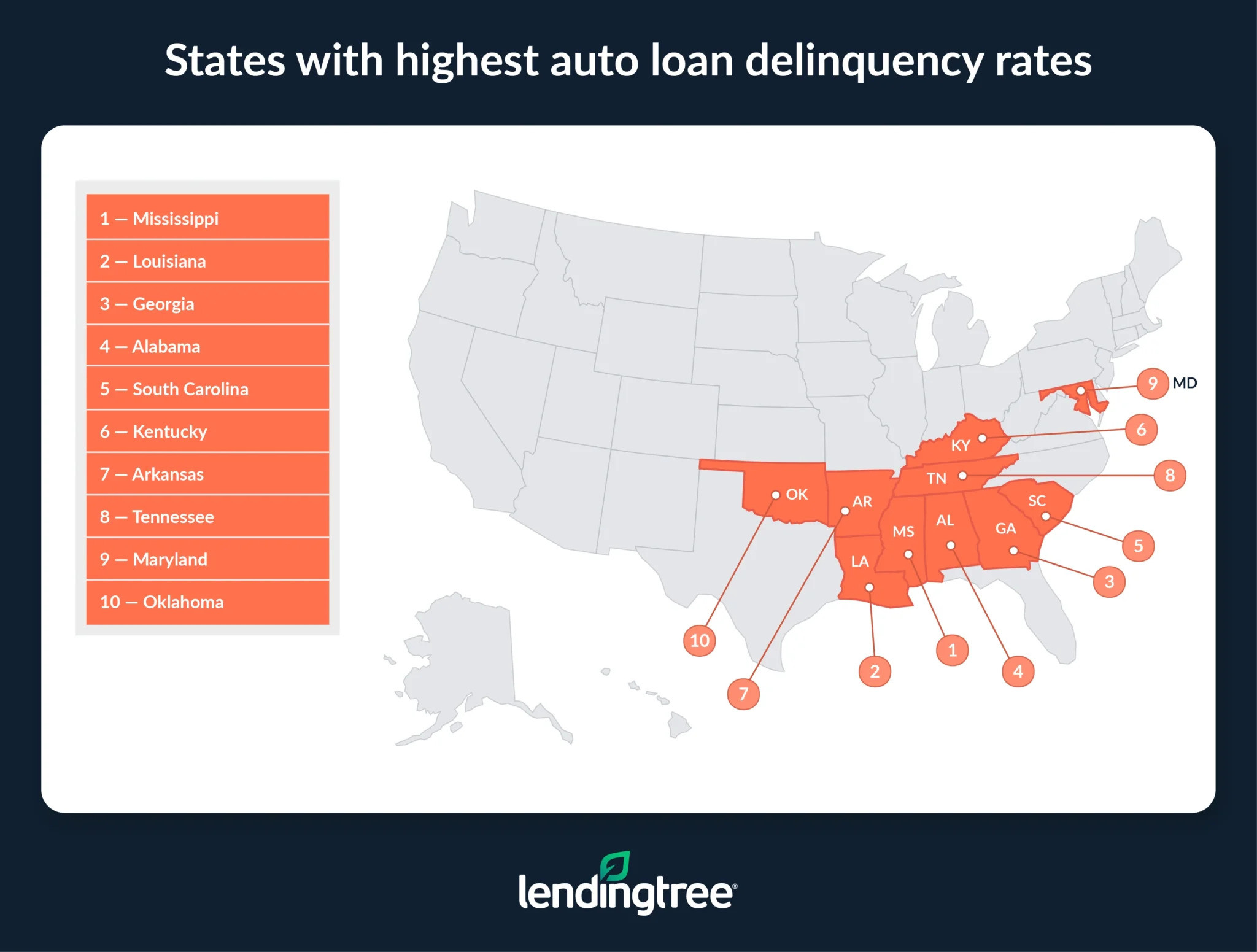

The hardest hit seem to be people in the South, and younger (Gen Z) borrowers. What’s more, delinquency rates have absolutely skyrocketed even in 2024.

I’m always skeptical whenever a regular Forbes “analyst” makes a dire prediction, but this sentence rings true: “When consumers start missing car payments, they’re already making hard trade-offs.” I think that’s right: when people in the US stop making car payments, it means they’re already in economic trouble in multiple other ways.

“They’re Skipping Car Payments; That’s The Final Warning Sign”

https://www.forbes.com/sites/jimosman/2025/07/15/theyre-skipping-car-payments-thats-the-final-warning-sign/ - Unpaywalled: https://archive.ph/ekOj3

Chart source: https://www.axios.com/2025/03/07/car-loan-payment-delinquencies-record-high - Unpaywalled: https://archive.ph/5LwdF

Map source: https://www.lendingtree.com/auto/delinquency-rates-study/