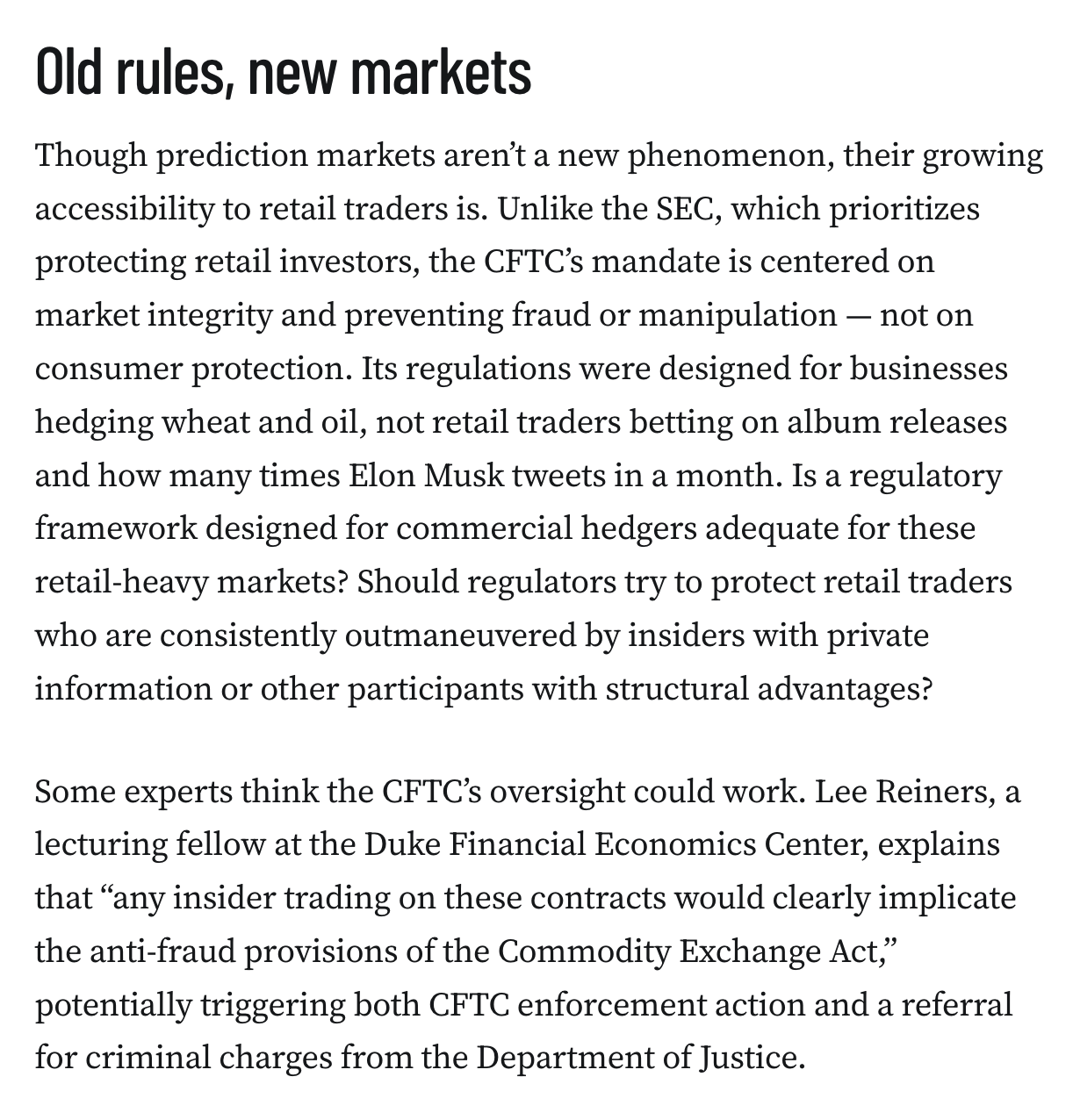

The regulatory landscape

The US financial regulatory landscape is divided among several agencies, with the Securities and Exchange Commission (SEC) overseeing stock markets and various other securities. The SEC aggressively pursues unlawful insider trading cases when people trade securities based on material non-public information. Former SEC official John Reed Stark explains, “The rationale for policing unlawful insider trading is that for the markets to work efficiently and fairly, everyone needs to be working with the same basic information, or at least, that those with special access to nonpublic information are prevented from taking advantage of it before other investors.”

But with the Commodity Futures Trading Commission (CFTC), which oversees prediction markets, it’s a different world. Trading based on non-public information is built into the system: a cattle rancher can use early calving data to hedge against future beef prices, even though others lack access to that information. Laurian Cristea, a lawyer specializing in financial services and CFTC exchanges, explains, “it’s not wrong to trade on information you properly know or developed through your business.” Nevertheless, rules against fraud or market manipulation still prohibit trading based on illegally acquired private information, or making false or misleading statements that impact markets, and CFTC-regulated exchanges like Kalshi are required to establish and enforce their own rules to maintain fair markets

![When billionaire Bill Ackman suggested on Twitter that Eric Adams could “place a large [Polymarket] bet on Andrew Cuomo and then announce [his] withdrawal” from the New York City mayoral race, he described something that feels profoundly illegal. A politician profiting from non-public knowledge of their own withdrawal from an election surely crosses some line — insider trading? Market manipulation? Election interference? Illegal gambling? Ackman ended his tweet: “There is no insider trading on Polymarket”1 — not because it doesn’t happen, but because it won’t be charged. He’s right: the Securities and Exchange Commission’s insider trading rules don’t apply here. But that leaves the question: what rules, if any, do?](https://media.hachyderm.io/media_attachments/files/115/215/799/203/367/899/original/eddb7e83cad3fb77.png)

![The regulatory landscape shifted further after Trump took office. The CFTC’s interim leadership began championing prediction markets as “an important new frontier”,4 and dropped both their appeal in the Kalshi case and an ongoing investigation into Polymarket’s continued accessibility to US users [I89]. Polymarket acquired a CFTC-regulated derivatives exchange, and a no-action letter from the agency greenlighted their re-entry into the US [I92]. With the administration’s deregulatory stance and a nominee for CFTC Chair who sits on Kalshi’s board [I90], this permissive approach is likely to accelerate in the coming years. More companies are eager to join the fray, with Crypto.com, Robinhood, and even the sports betting company FanDuel adding event contracts to their offerings. Eyeing this lucrative market, they’re likely to follow their predecessors’ lead in pushing regulatory boundaries even if it means expensive litigation. Following the crypto industry playbook, they may also lobby Congress for special exemptions.](https://media.hachyderm.io/media_attachments/files/115/215/809/149/334/167/original/94379f4f96be229a.png)

![In 2020, the US-based Polymarket began allowing customers to use cryptocurrency to trade events contracts, though they made no effort to certify their contracts with the CFTC. In 2021, Kalshi emerged as the first fully regulated prediction market in the US, following a hard-won CFTC approval. That platform allowed traders to stake up to $25,000 on outcomes ranging from COVID-19 vaccination rates to record-breaking temperatures.

The CFTC cracked down on prediction markets in 2022. First, they hit the unregistered Polymarket with a $1.4 million fine and ordered it to stop offering unregistered event contracts to US customers, effectively shutting the platform out of the American market.2 Then they revoked PredictIt’s no-action letter,3 apparently concluding the platform had expanded beyond its academic purpose into a commercial enterprise. PredictIt challenged this decision in court, winning a preliminary victory in 2023 and a final one in 2025. In 2023, the CFTC ordered Kalshi to stop offering markets on which party would control Congress after the upcoming elections, citing the Commodity Exchange Act’s prohibition on “gaming”. Kalshi also mounted an aggressive legal challenge, and when a district court ruled in Kalshi’s favor in 2024, the company swiftly reinstated the contested markets [I66].](https://media.hachyderm.io/media_attachments/files/115/215/808/036/938/633/original/593b4dcc96be0b60.png)

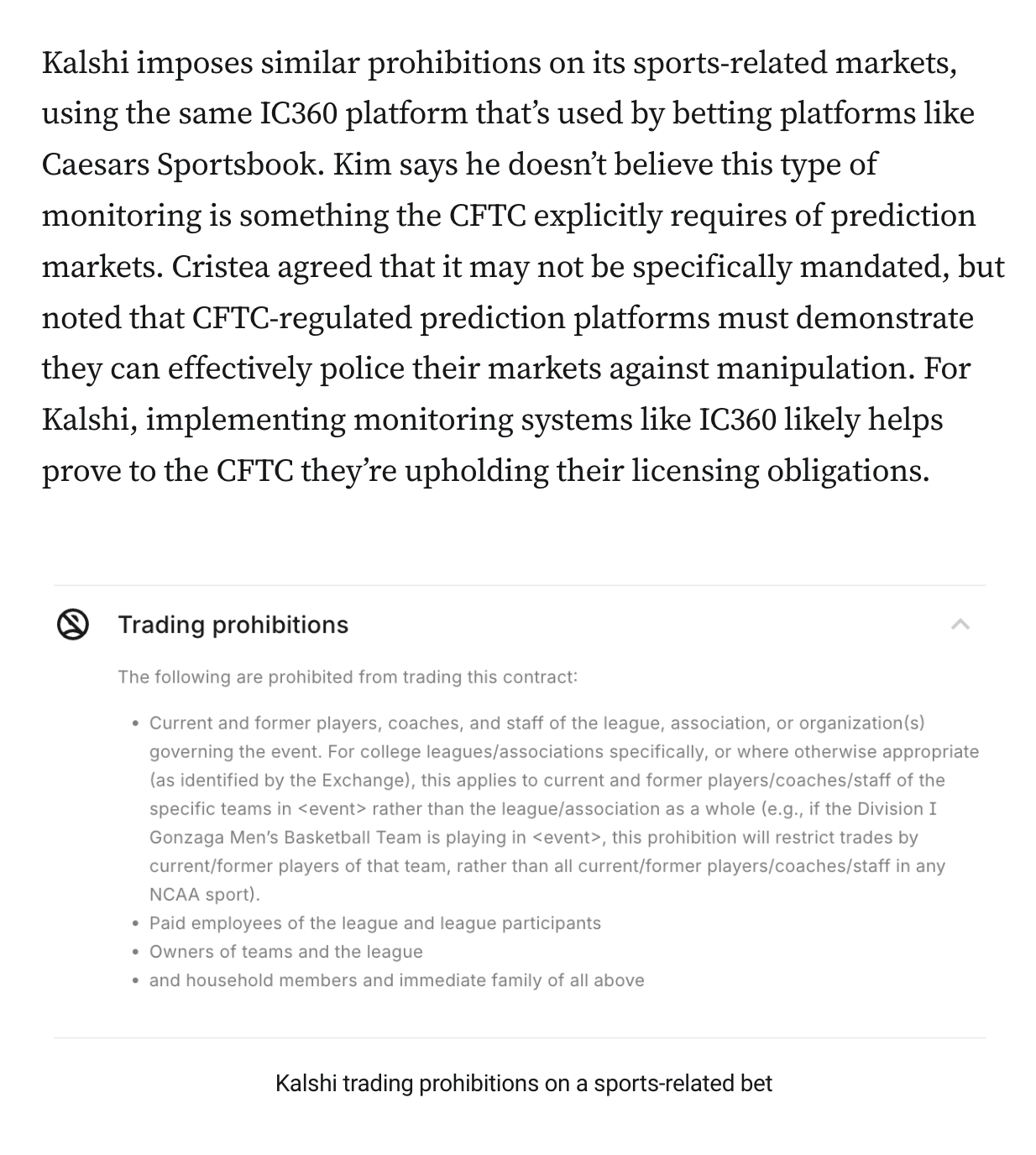

![When I asked Cristea about the CFTC’s ability to oversee retail markets, he pointed to the CFTC’s track record regulating Futures Commission Merchants (FCMs), which facilitate trading of futures and derivatives. While institutional clients still dominate these markets, retail participation has grown significantly in recent years. However, he notes a key difference in consumer protections: “FCMs don’t have the same sort of requirement for a customer suitability analysis that applies to broker-dealers in the securities context.” Broker-dealers are obligated to assess whether specific investments are appropriate for specific customers. For example, if a 65-year-old retiree with limited savings tried to make a substantial investment in a high-risk stock, a broker-dealer would need to evaluate whether the investment suited her financial situation and could refuse inappropriate trades.

Cristea also expressed concerns about enforcement capacity. “The current administration takes a more free market, caveat emptor-type approach. That said, even when the CFTC got jurisdiction over a very large swaps market the agency’s budget was not increased much. And together with this deregulatory trend, agencies getting smaller in size, where agencies are being told to do more with less, I am not sure the CFTC will necessarily come out with [additional retail] protections unless the agency sees that as a necessary step for credibility and for the market to thrive.” The CFTC has yet to bring](https://media.hachyderm.io/media_attachments/files/115/215/821/936/485/862/original/1f734b55f3abf9be.png)

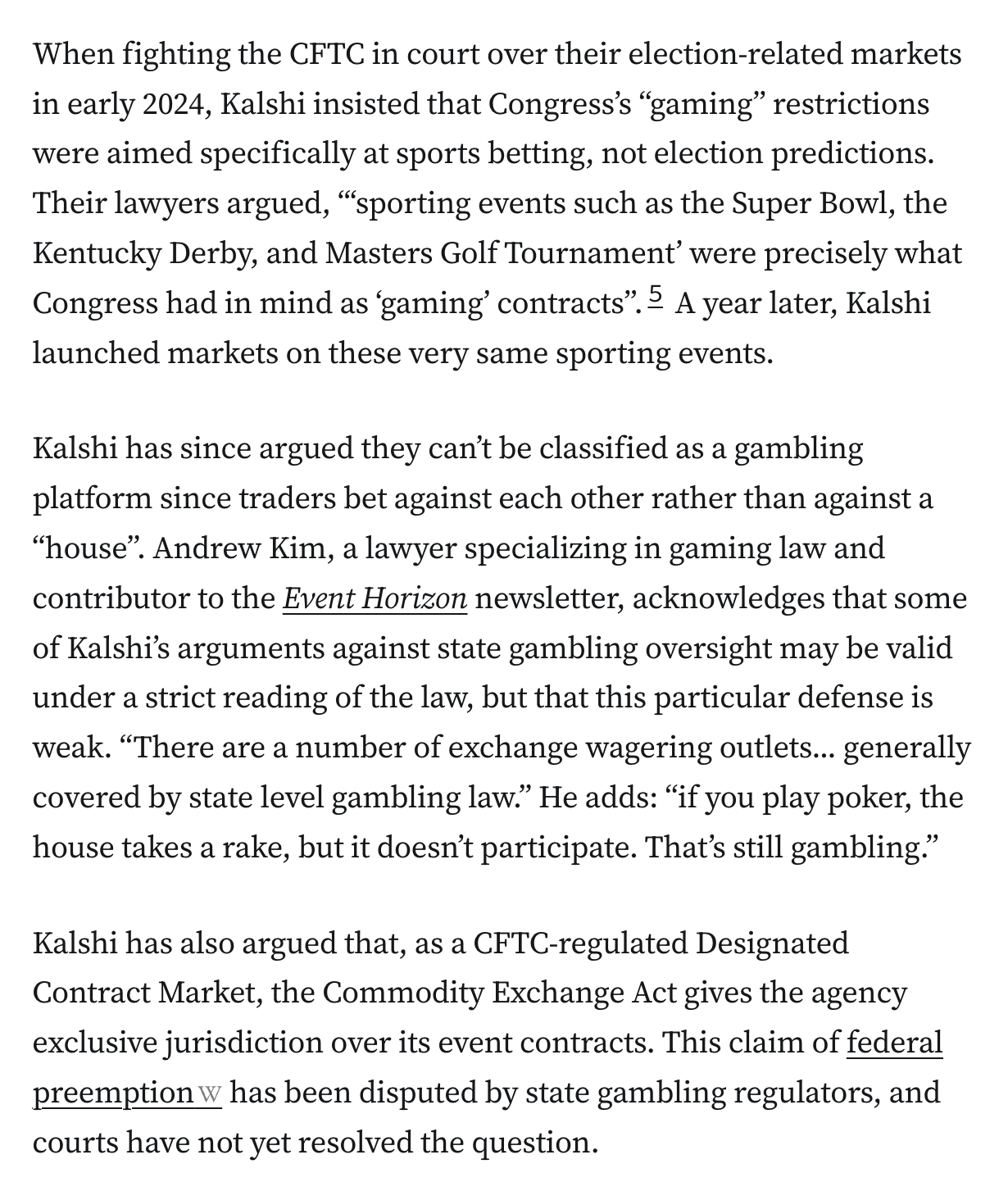

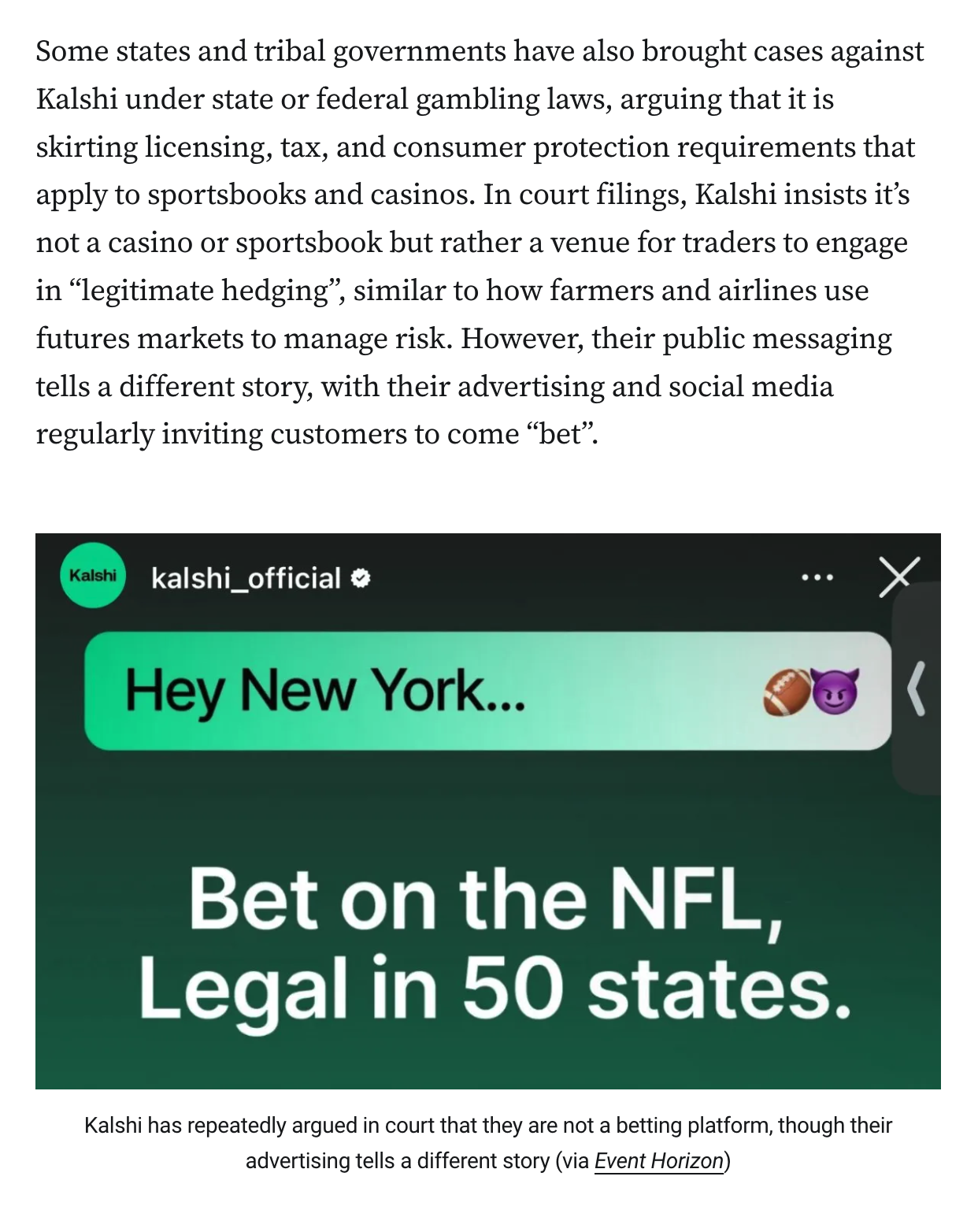

![Other industries that deal with outcome-based bets, like sports wagering, have evolved robust integrity systems both to protect consumers and to preserve trust in the games themselves. Kim explains, “The reason for [these rules] is because of the mob, because of the history of gambling and the mob fixing matches. You have a rather sketchy history of criminal influence on the outcome of matches, and so you want to prevent that by just having very strict rules, like if you’re involved in the event, you can’t play, period.”

Today, sports betting platforms work to screen out athletes, referees, and sports program employees to ensure they’re not betting on games they could potentially influence, and employ monitoring programs to detect suspicious bets. This vigilance has proven effective: recent scandals involving illegal betting by Iowa State football staff and the University of Alabama’s baseball coach were first flagged by the platforms’ monitoring systems. Their vigilance is likely because, as Kim says, “the penalties for the operator can be severe. It might be a fine. It might be the license getting pulled.”](https://media.hachyderm.io/media_attachments/files/115/215/832/789/839/038/original/5ac067f782a54db5.png)