I bought over 1k share of this at $3. This is wild.

TIL that major US banks silently got billions in bailouts over the last few months, AND a self-imposed short squeeze by JP Morgan, which

is on the hook to deliver more than 5,900 tons of silver it doesn’t have. Tradeable silver is relatively scarce right now, government data shows.

and

A big problem [ed: for JP Morgan] is that there’s not enough actual silver available for trading to get JP Morgan out of the squeeze it got into through unbridled greed. The more silver prices rise the more JP Morgan gets hurt.

yup sure sounds like the US economic pieces are doing just fine right now!

https://www.dcreport.org/2025/12/29/ny-fed-unlimited-cash-infusions-bank-crisis/

#politics #bank #banking #JPMorgan #ShortSqueeze #short #shorts #investing #USPoli

Wall Street Sees AI Bubble Coming and Is Betting on What Pops It

#HackerNews #WallStreet #AI #Bubble #Investing #Technology #Trends #MarketAnalysis

Crypto treasury companies — narratives before fundamentals

1. Buy Bitcoin.

2. Hype it up with memes and tweets.

3. Watch the stock price soar (because why not?).

But now, the narrative is broken.

Is this the end of ‘hype capitalism’?

https://www.youtube.com/watch?v=fhsrkvEY55s

#CryptoDebate #Bitcoin #Finance #Investing #MemeEconomy

✨ Tonight was our final 2025 board meeting with the Malden Chamber of Commerce.

🤝🏽 Grateful to work alongside such dedicated leaders—what a year of connection, collaboration, and community. Onward to 2026 to continue our mission for equitable economic growth and help our vibrant community thrive! 🇺🇸

#maldenma #business #SmallBusiness #equity #Investing #community #commerce #leadership #ShopLocal

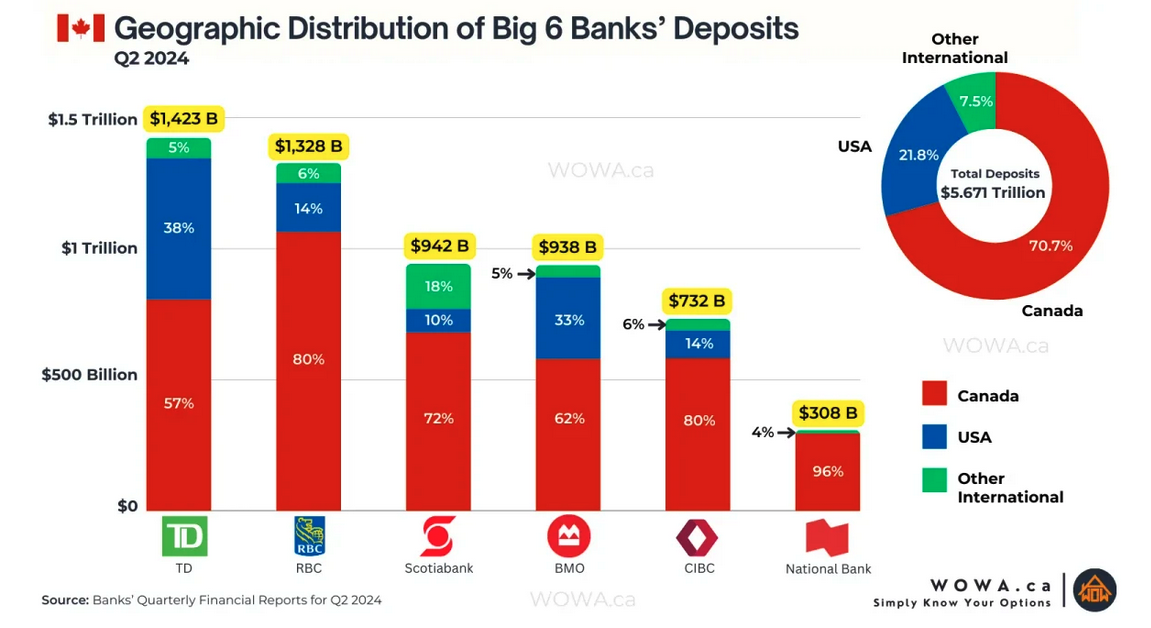

In case you're interested in the state of the Canadian banking landscape and geographic exposure, I just came across this chart, which seems useful that way.

All of them nickel and diming us on fees and services of course, but if you're worried about your savings and which bank is most exposed to the kleptocracy south of the border, TD is the worst and National the best, against that broad measure.

In case you're interested in the state of the Canadian banking landscape and geographic exposure, I just came across this chart, which seems useful that way.

All of them nickel and diming us on fees and services of course, but if you're worried about your savings and which bank is most exposed to the kleptocracy south of the border, TD is the worst and National the best, against that broad measure.

Congressional lawmakers 47% pts better at picking stocks

https://www.nber.org/papers/w34524

#HackerNews #Congressional #Lawmakers #Stock #Picking #Better #Stocks #Investing #Finance

Many years ago, I came across something called the 'Vice Fund', a fund that invested in tobacco, alcohol, and guns. They had some numbers that showed that they tended to do really well when the overall market went down, and have slightly worse returns than average when the market was doing well.

If I could find them again, I'd probably invest...

@david_chisnall @samir @mawhrin @GossiTheDog

If they include book-keeping and junk or fast-food, I'm in too!

Taking Money off the Table

https://zachholman.com/posts/money-off-the-table

#HackerNews #Taking #Money #off #the #Table #finance #investing #personalfinance #startups #entrepreneurship

As Japan’s new prime minister promises economic revival, investors are brushing up on the language of the stock market — and “Sanaenomics.” https://www.japantimes.co.jp/life/2025/10/30/language/takaichi-stocks-sanaenomics-investing/?utm_medium=Social&utm_source=mastodon #life #language #nihongo #vocabulary #sanaenomics #sanaetakaichi #halloween #investing

I have red this blog again and i am thinking about it's implications. I think @pluralistic is right and i am someone who is optimistic about AI and it's technological capabilities....

Or are there any counter arguments?

Financial AI Armageddon is near...

https://pluralistic.net/2025/09/27/econopocalypse/#subprime-intelligence

#AI #armageddon #bubble #finance #investing #geopolitics #ICT #LLM @geopolitics

I have red this blog again and i am thinking about it's implications. I think @pluralistic is right and i am someone who is optimistic about AI and it's technological capabilities....

Or are there any counter arguments?

Financial AI Armageddon is near...

https://pluralistic.net/2025/09/27/econopocalypse/#subprime-intelligence

#AI #armageddon #bubble #finance #investing #geopolitics #ICT #LLM @geopolitics

How rich people avoid paying tax

(Originally by Instgram user @newmoney.blog)

"Trump's 50% #tariff on #India kicks in as Modi urges self-reliance."

#CNBC

#SquawkBox

#Republicans

#tariffs

#inflation

#recession

https://www.bbc.com/news/articles/c5ykznn158qo

It's very possible #Republicans will send World business to tariffs free #China as a simple solution to Trump #tariffs causing short term #recession as world economic activity shifts away from the #UnitedStates

#tradewar

#premarket

#CNBC

#investing

“We must unite and take a clear stand against unilateralism and protectionism,” Xi said."

https://www.theguardian.com/us-news/2025/aug/27/trumps-tariffs-trade-war